Salutations

Prof. James Tooley, Vice-Chancellor, University of Buckingham;

Hon. Greg Smith, Member of Parliament for Buckingham;

Hon. Margaret Gateley, Mayor of Buckingham;

Lord Mark Malloch Brown, Former UN Deputy General Secretary;

Rt. Hon. Abena Oppong Assare, MP Shadow Exchequer Secretary to the Treasury

Mr. Mark Seddon, Director of the Centre for UN Studies;

Members of the Faculty;

Students ;

Friends of the Media;

Distinguished Guests;

Ladies and Gentlemen.

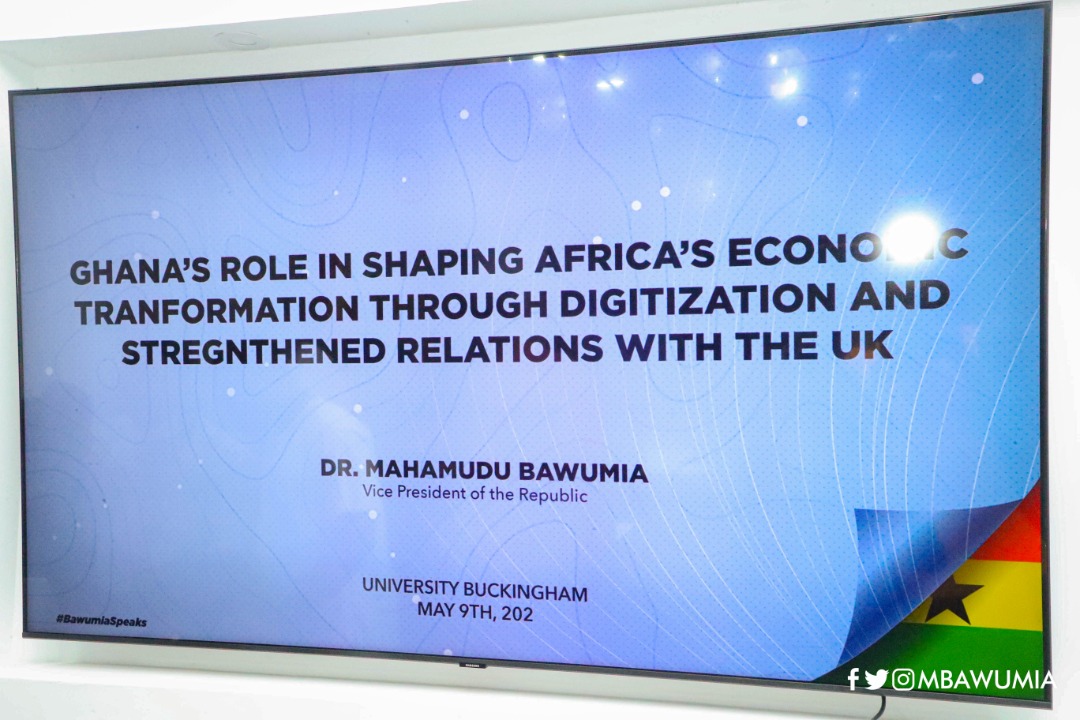

I would begin by expressing my appreciation to the organisers and management of the University for inviting me to deliver the Fourth Annual Center for United Nations Studies Lecture on the theme: “Ghana’s role in shaping Africa’s Economic Transformation through Digitalisation and Strengthened Relations with the UK.”

Unfortunately, due to circumstances beyond my control I could not be with you in person. Please accept my sincere apologies. Even though we are doing this via Zoom, I feel like I am back in Buckingham and I am thankful for the fond memories and opportunities at Buckingham University that have become part of my life story. Being the 2nd largest economy in Europe and 6th largest economy in the world, the UK presents Ghana and Africa with a unique opportunity in our quest for economic transformation. An opportunity enshrined in deep historical ties.

Scholars and development experts across the world have taken particular interest in the nature and progress of Africa’s development especially after the attainment of independence from colonial rule. The renowned Kenyan-American Political Scientist, Ali Mazrui addressed the challenge of Africa’s fragmentation and its attendant development problems in his 1979 Reith Lectures on the paradoxes of the African Condition, arguing in his first paradox that Africa occupies a central position on the world map yet remains the most marginalized continent in terms of development notwithstanding its vast land and mineral and natural resources.

There has been no shortage of diagnosis about why this is the case. Indeed, despite being the world’s fastest-growing continent in the last decade, Africa’s development is still saddled with governance problems. Coup d’etats have recently taken place in Mali, Burkina Faso, Chad, Guinea, Sudan in an apparent reversal of the democratic march of the continent. Other challenges include the structural dependence on the export of primary commodities which face declining terms of trade, corruption, poor domestic revenue mobilization, debt unsustainability, low mechanised production capability and small economies due to the relatively small sizes of most states, and low trade between African countries.

Since independence, African leaders have taken measures to address some of these bottlenecks to development, mainly through the mechanisms of the Organization of African Unity (OAU), now African Union. I am happy to say that progress has been made over the years in addressing some of the problems.

The signing of the African Continental Free Trade Area Agreement (AfCFTA) in Kigali, Rwanda, in March 2018 was a bold step by African leaders to expedite economic development and achieve prosperity for our growing populations.

Historically playing a quintessential role in shaping the African philosophical, intellectual, and developmental agenda, Ghana once again played a leading role in establishing the AfCFTA. Therefore, it did not come to us as a surprise when Ghana was chosen to host the AfCFTA Secretariat.

Scholars and policymakers have predicted that the AfCFTA is a game-changer for Africa’s development as it creates leverage over the decades-long developmental challenges. Yet, at the same time, we acknowledge that the acceleration of Africa’s economic transformation could be achieved through strategic use of digitalization and mutually beneficial external partnerships.

Africa missed the agricultural revolution and the industrial revolution. My view is that, fundamentally, the “Systems” underpinning the economies of most African countries are not “systems” that can transform our economies and make us globally competitive. The Fourth Industrial Revolution (the digital revolution) is upon us, and Africa cannot afford to miss it.

There is a growing body of empirical evidence that illustrates the capacity of digital technology to create jobs, significantly boost productivity, increase income and support wealth creation. For example, the World Economic Forum’s Global Information Report estimates that “an increase of 10% in a country’s digitalization score fuels a 0.75% growth in GDP per capita”. It is therefore clear that going forward, countries that fail to digitalize their economies are likely to be uncompetitive in the emerging global digital revolution.

Ladies and gentlemen, the first thing to note in talking about the digital revolution is that it is a data revolution. The Economist Magazine put it this way in 2017; “The world’s most valuable resource is no longer oil, but data.” Data is as important in this Fourth Industrial Revolution as oil discoveries were for countries decades ago. Data is the basic requirement for participation in the digital revolution, but it was clear that the “systems” underpinning the operation of African economies were not designed for a data driven economy.

NATURE OF THE SYSTEMS

Citizens and Residents cannot be uniquely Identified.

It is possible to be born in many countries in Africa, live a full life, die and be buried and there would be no trace of you on any documentation that you ever lived and died in these countries.

There is also the Inefficiency and Corruption in the Delivery of Public Services

In the day-to-day interactions of Africans, whether in applying for driver’s license, passports and any form of government permit or license, at the local or national level, corruption has been so ingrained that bribe giving and taking are often tolerated to the point of being considered as normal behavior.

Lack of a functional National Property Address System

No modern economy can function without an address system.

The existence of a large Informal Sector and the dominance of cash payments

Financial Exclusion – over 60% of the adult population have no bank accounts.

Our government databases are largely manual and not integrated

The difficulty in collecting taxes for development

The vast majority of the population do not file to pay taxes and there is no way of finding out.

Inefficiency in the delivery of Health Services

Medicines, Vaccines, Blood, hospitals, manual records

These are the elements underpinning the “Systems” in operation in many African countries.

How prepared is Africa to compete in the emerging global digital revolution? Have we got in place the key pillars that would enable our economy to participate in the emerging digital revolution? Is the “system” we have fit for purpose?

BUILDING A NEW SYSTEM FOR DIGITAL TRANSFORMATION

All the challenges I have described so far are symptomatic of the disconnect between government machinery on the one hand and the lives of ordinary Africans. The system frustrates rather than help ordinary people.

The question to ask is: why is it that after over sixty years of independence in Africa, after all the years of IMF and World Bank programs, after all the foreign aid, and development assistance, “The System” has remained basically the same or in some cases got worse.

In 2010, eleven years ago and 7 years before I became Vice President of the Republic of Ghana, I addressed this issue in the conclusions of a book on Monetary Policy and Financial Sector Reform in Africa. I noted in this book that international development is a very competitive game. But unlike the game of football where the rules are clearly defined for all participants, not all the rules of the international development game are written down.

Putting in place a unique identification number, having a unique address system, and financial inclusion. are just some of the key unwritten rules for efficient economic development.

The focus of economic management by successive governments since independence in Africa has been on crisis management as a result of factors such as collapse in commodity prices, increase in oil prices, debt unsustainability, political instability, macroeconomic instability, etc. Governments, have by and large, not focused on the underlying system that underpins economic activities.

I concluded in the book, inter alia, that digitalization was the path to modernizing and transforming the Ghanaian economy.

The goal of our government upon assumption of office was to quickly transform our economy by leveraging on technological innovations as a means to leapfrog the development process, overcome legacy problems, and improve both economic and public sector governance. This is why digitalization has been a major area of focus for our government. The reality is that in this era of the fourth industrial revolution, if you don’t digitalize you will not have much of an economy, PERIOD!

The World Bank President, David Malpass at the G20 summit last year stated that:

“ Without digitalization, we wont be able to reap the full benefits of human progress.

This statement is a validation of why Ghana has rightly focused on digitalization in the last five years. Our strategy since 2017, has been to build a new “system” through digital transformation.

What are the elements of this “new system” for digital transformation? We set out to build:

- A system with unique identification numbers for the population

- A system with addresses for all properties and locations

- A system that is transparent, and promotes accountability, discipline and trustworthiness.

- A system that is inclusive and not based on who you know

- A system that provides efficient public services delivery and tackles corruption

- A system that improves efficiency in the health and education sectors

- A system that provides financial inclusion and a cash-lite economy

- A system that enhances domestic revenue mobilization (tax collection)

Ghana’s experience with digitalisation and lessons for Africa

Ladies and gentlemen, in 2017, when Ghana’s new Government was sworn in under the leadership of Nana Addo Dankwa Akufo-Addo, we realized that while Ghana’s digital journey had started decades ago, progress was slow. There was the need for a major executive buy-in to build a transformational digital ecosystem. While a considerable amount of regulatory framework was already in place to underpin the digital ecosystem, particularly for financial inclusion and national identification, implementation of the actual systems was lagging behind considerably.

For example, Ghana’s Payment Systems Act was passed in 2003 in response to the need to develop non-cash payment products and clearing systems in order to reduce overdependence on cash payments in the economy. The enhanced work of mobile money interoperability was achieved a few years ago under our government.

Another example is the National Identification Project. As far back as 1973, Ghana issued national identification cards to citizens in certain border regions. The project stalled due to logistical and technical challenges. The project was revisited in 1987 and 2001. Subsequently, in 2006, the Act to establish a National Identification Authority was passed. As I go on, I will discuss how we have finally implemented a successful National Identification System, which has been critical to formalizing the economy. I will now come to how we have used digitization to solve various problems in Ghana.

Building a database

The first thing to note when talking about digitalization is that it is a data revolution. Data is the basic requirement for participation in the Fourth Industrial Revolution. But it was clear that the system underpinning the operation of Ghana’s economy was not designed for a data-driven economy.

Therefore, we set off on our digitalization journey from the basics, getting the data right. We launched two projects, one to build a database to capture the identity of people (the Ghanacard Project) and the other to build a Property Address System.

With close collaboration with the West African sub-regional group, about 15.9 million people, over half of the Ghanaian population, have been enrolled on the Ghanacard, which doubles as an ECOWAS Identity (ID) card and an e-passport.

To solve the problem of the lack of a working address system in Ghana, we have leveraged GPS technology to implement a digital address system for Ghana. The successful implementation of Ghana’s Digital Address System provides a platform for enhanced e-commerce, financial access, crime control and public safety.

With the Ghanacard successfully implemented, we are embarking on an integrated national database system which will see all records of a person integrated into one single database.

For instance, all sim card registrations, drivers’ licenses, national health insurance, tax identification, births and deaths records, social security, bank accounts and all other public records are being integrated into the National Identification Authority database and would be accessible on the Ghanacard.

Starting later this year, it is envisaged that every newborn child will, within a few months, get a Ghanacard number, but the actual card will be issued when the child is grown, and the biometrics are fully formed (after age 6). It was possible for a child to be born, grow up, die at an old age, and there will be no record of such a person. Now, we can solve this situation with the Ghanacard, and Government will have visibility on the data analytics to inform public and economic policy.

Digitalisation and integration of databases will deal, in most part, with the governance, corruption and service delivery inefficiencies affecting economic transformation in the country.

Digitalisation and governance

Our approach to improving the delivery of public services is to minimize human contact as much as possible. Therefore, we embarked on an aggressive digitalization of service delivery processes across many public institutions with coordination from my Office. I will proceed to outline some of these digitalized services:

Digitalization of the ports (Paperless Ports): Ladies and Gentlemen, a major source of revenue for the Government are our national ports. Previously, the bureaucracy in clearing goods at Ghana’s ports involved a lot of paperwork and used to be largely manual. This caused delays, corruption, inefficiencies, frustration and loss of revenue to the Government.

The introduction of a paperless port system has reduced the layers and simplified the process, reducing the cost and time needed to clear goods and the avenues for corruption. Digitalizing the port’s processes has increased efficiencies and revenue mobilization.

Digitalization and general service delivery: Ladies and gentlemen, there are many other important government services that have seen significant boosts in efficiency and revenue generation through our digitalization agenda. I will mention a few briefly.

With digitization, the acquisition of Ghanaian passports has become much easier, convenient and efficient. People can now apply for passports from the comfort of their homes, and also be delivered to them at home by courier. This has led to a rapid increase in the number of applications and revenue. As of 2017 the passport office processed a total of 16,232 applications with a revenue of GHC1.1 million, while in 2021, 498,963 online passport applications were processed with total revenue of GHC56.7 million.

With the digitalization of acquisition of drivers’ licenses and motor vehicle registration in 2019, we experienced an increase in service by 109% in 2020. The customer now saves as much as 200% on the cost of vehicle services and 264% on drivers’ licenses service. Government also generated average revenue of GHc 71.5 million in the four years (2013-2016) prior to digitization as compared to the average revenue of GHc 168.4 million in the four years (2017-2020) with digitization.

Again, with the digitalization of motor insurance in Ghana, all insurance policies, which now have key security features, have been synchronized to a national database, which can be accessed simply with any mobile phone by the insured, the Police, and the public by dialing a USSD code *920*57#. Following the digitalization of motor insurance, the value of the business has increased from GHC 566 million in 2017 to GHC2.3 billion in 2021.

In education, scholarship candidates can now make applications from the comfort of their homes, take an aptitude test and be interviewed in their own districts through digitalized services in the secretariat.

Games are not left out as Government, and the Ghana Football Association piloted an e-ticketing system for the recent World Cup qualifying match between Ghana and Nigeria at the Kumasi Sports Stadium. People who wanted to buy tickets could do so on the mobile phone. No need to waste time queuing for tickets. It was a successful pilot and yielded the highest ever revenue (GHC 1,423,400) for a football match in the history of Ghana. This system is now going to be rolled out to all major stadia in Ghana.

The Ghana.Gov Platform: To make it easy to access government services, the Government launched the Ghana.gov portal, a one-stop-shop for accessing government services. This means that people in and outside Ghana can apply for and obtain any government service online through the Ghana.Gov platform, with all payments going directly into the government account.

Digitalisation and financial inclusion

Ladies and gentlemen, financial exclusion has been a major problem in Ghana for decades. But research shows that the use of mobile technologies and mobile internet enhanced financial services are growing faster in Africa than in any other continent. What we needed to put in place was a digitalized system to facilitate these forms of informal banking and other financial services using mobile technologies. Mobile money interoperability came in handy. Ghana now has full interoperability making it possible to transfer money seamlessly across different mobile money providers and between bank accounts and mobile wallets.

Because of mobile money interoperability (MMI), you can transfer money from a customer of one mobile money service provider to a customer of a different mobile money service provider; and also make payments from your mobile money account into any bank account, and you can receive payments from any bank account into your mobile money account.

Because the mobile money account performs just like a bank account due to MMI, over 90% of adult Ghanaians have bank accounts or mobile money accounts that function like bank accounts and can also receive remittances from abroad directly onto your mobile phone without the need to go to a bank. We have practically solved the problem of financial exclusion in Ghana.

This effectively makes Ghana one of the few in Africa and other developing countries to achieve this type of interoperability between bank accounts and mobile wallets. In this area, we are way ahead of most countries globally. The data shows that because of MMI, Ghana is the fastest growing mobile money market in Africa. Following MMI, the total cumulative value of mobile money transactions increased to GHC 978.3 billion ($140 billion) in 2021 (a twelve-fold increase!).

We have also implemented a universal QR CODE payment system for both mobile wallets and bank accounts.

The digital payments infrastructure is boosting e-commerce in Ghana. Businesses are booming over Instagram, Facebook, Twitter, etc. Many people who cannot afford to rent or build shops are able to do business on the internet at little cost, with deliveries helped by the digital address system and payments using mobile money interoperability.

The Central Bank of Ghana is currently piloting the e-cedi, a Central Bank Digital Currency (CDBC), to promote diverse digital payments while ensuring a secure and robust payment infrastructure.

Digitalization of domestic revenue mobilization: Ghana has a major challenge in domestic revenue mobilization. The tax/GDP ratio is about 14% compared to 27% for South Africa and 34% for the advanced (OECD) countries.

Most adults are outside the tax net, and compliance is very low. At the beginning of 2017, only 4% of the adult population of Ghana had Tax Identification Numbers (TIN). Broadening the tax net was therefore imperative. To increase the number of people with Tax Identification Numbers, we took the decision to designate the Ghanacard number as the Tax Identification Number.

In doing this, we have significantly increased the percentage of adults with Tax Identification Numbers from 4% as of 2017 to 85% in 2022. In terms of revenue losses, integrating the databases is allowing us to successfully weed out ghost names on the government payroll and other payment platforms.

A biometric audit of the National Service Scheme payroll alone found 14,027 ghost workers and saved the country GHC 112 million (approx. USD 15 million).

Digitalization of Hospitals and Medical services: We have embarked on connecting all health facilities to one digital platform. So far, 36 health facilities in the country’s Central Region have also been connected to the digital platform in a pilot scheme. The process for other hospitals is ongoing, and we expect this to be completed next year.

If you are referred from a hospital in one part of the country to another, you would not need to carry a folder. All your records will be seen and monitored by the medical personnel in Korle Bu when you arrive. Patients will have only one digital folder wherever they go.

Again, following digitalization, the renewal of national health insurance registration via mobile phone has eliminated all bottlenecks and improved access to health care by those who need the services most. This has led to an increase in renewals by 70%, while new registrations have increased by 41% per annum. Digitalization is helping to stamp out corruption and inefficiencies in the health service as well.

Medical drones: Hospitals and clinics in remote and largely rural communities in Ghana have difficulty getting medical supplies, especially in times of emergencies involving, for example, snake bites, childbirth, blood supplies, floods, etc.

To address this problem, Ghana partnered with Zipline, the world’s largest automated on-demand delivery service for medical supplies. Ghana is now the second country in Africa (after Rwanda) to implement the delivery of medical supplies to remote areas through drones.

The medical drones have made millions of deliveries of medicines, blood and vaccines to very remote parts of Ghana and have saved many lives.

I should add that Ghana currently has the largest medical drone delivery service in the world, 100% manned by young talented Ghanaians.

National Electronic Pharmacy Platform: We have completed work on a digital platform for all pharmacies in Ghana, and a pilot scheme of 45 pharmacies has been completed. Basically, the National Electronic Pharmacy Platform will offer the opportunity to everyone through a mobile phone to upload their prescriptions and find out the closest pharmacy to get the prescribed medicine.

Secondly, they can compare the prices for the same drug so that they can buy from the lowest priced pharmacies. Customers will also be able to order the drug and pay for it on the phone through mobile money or other channels. The medicines are then delivered to the customers at home through a courier service provider.

The National Electronic Pharmacy Platform will be formally launched in the next few weeks and will make Ghana one of only a few countries in the world with a national scale E-pharmacy.

As a government, we are acutely aware of the myriad challenges around building a digital economy. The priority we give to the “digital economy” explains why we have The Ministry of Communication and Digitalization. There are regulations, institutions and systems we have put in place to help mitigate the attendant risks. For example, The Data Protection Act recently passed in 2018 under which a Data Protection Commission is established, is there to protect individual’s privacy and personal data. Ghana’s Cyber Security Authority has been established under the Cybersecurity Act, 2020 (Act 1038) to regulate cybersecurity activities in the country.

Digitalisation and Ghana’s economic transformation agenda

Ladies and Gentelemen, the average rate of GDP growth in Ghana for the period 2017-2021 (including the COVID-19 period) was 5.3%. In per capita terms, GDP per capita has continued to increase from GHC 7,757 in 2016 to GHC12,389 in 2020 (notwithstanding COVID-19). This represents an increase in GDP per capita by some 60% since 2016.

In the context of sub-Saharan Africa, GDP growth in Ghana has consistently outpaced average growth in sub-Saharan Africa since 2017. Even in 2020, when because of COVID-19, SSA recorded negative growth on average, Ghana was one of the few countries with positive growth.

While growth in Ghana averaged 5.3% from 2017 to 2021, the SSA average for the same period was 2.3%. GDP growth in Ghana was, therefore, more than double the SSA average.

Lessons for Africa

Ladies and Gentlemen, in January 2022, the Pan African Payment and Settlement System (PAPSS) was launched at the AfCFTA Secretariat in Accra. This system is one of five pillars supporting the effective implementation of the AfCFTA.

Working closely with African central banks, the PAPSS aims to facilitate the efficient flow of capital securely across African borders, minimizing risk and contributing to financial integration across countries.

All forms of transactions, including shopping, transfers, salaries, stocks trade, and all high-value transactions are supported by the real-time infrastructure provided by PAPSS. In my view, and with the experience of Ghana, the Pan African Payment and Settlement System offers a rare opportunity to integrate Africa’s financial sector to ensure seamless trading under the AfCFTA.

This is a giant step toward digitalizing payments and settlements in Africa. In the long run, if successfully implemented, the PAPSS promises to be a major facilitator of digitalized financial and economic structures in Africa. Digitalization of finance and economies in Africa are the sine qua none of transforming our economies.

As a member of a government that has chalked so much success in digitalization and financial inclusion within a period of five years, I can attest to the challenges and hurdles that need to be overcome, but with commitment and political will, Ghana has demonstrated that African leaders can achieve prosperity for their people through digitalization.

Ghana and Africa-UK relations

Ladies and gentlemen, permit me to go back to Ali Mazrui’s first paradox on the African condition: “Geographically, Africa is the most central of all continents, but politically and militarily’ it is probably the most marginal.”

Africa is the second-largest continent, second only to Asia in population and landmass. With a population of over 1.2 billion on a total land area of almost 30 million square kilometres, Africa has a median age of 19.7 years. With the inception of the AfCFTA, which has a combined GDP of three trillion US dollars and a market of 1.2 billion, the continent may have been marginalized in the past, but it is no more. In fact, Africa is the future.

Nevertheless, the success of the African story will depend on the nature of partnerships it forges with its external partners. The UK has a major role to play. The UK’s longstanding historical ties with Africa and impressive development trajectory puts it in a unique position to partner Ghana and other Africa countries for strategic development in economic transformation, trade and investment, technical cooperation and boosting intra-regional trade. I will focus on two core sectors – agriculture and industrialization.

It is remarkable to note that the UK has one of the most advanced mechanized agricultural sectors in the world, with just 2% of the workforce producing about 60% of the population’s food needs. The good news is that Africa has vast fertile land suitable for agriculture, it has the human resource, and all it takes to be the world’s food basket.

Ironically, Africa remains the most malnourished region in the world. What it means is that there is an untapped opportunity for Africa-UK relations. This is a partnership that will take advantage of the 1.2 billion market being created by the AfCFTA and help Africa deal with its chronic malnutrition and famine that will yield prosperity for both African and British farmers.

Secondly, Africa’s quest for industrialization has seen very slow progress over the decades. However, with the creation of the continental market, there is a new impetus to revitalize industries on the continent. In Ghana, we have the ambitious one district one factory policy being rolled out by our government. This policy seeks to either build a new or revamp a factory in each district across the country.

Other areas that the UK can partner with Ghana and other Africa countries include mineral processing; oil and gas; tourism; energy; infrastructure; utilities; finance; and health.

For us, the commitment to Ghana-UK relations has never been in doubt and has seen recent boosts. This is manifest in the establishment of the UK-Ghana Business Council (UKGBC) in October 2018, as a high-level forum to promote bilateral relations and strategic partnerships between the private sectors of Ghana and the UK for trade and investment.

Our commercial relations received a further boost on 2nd March 2021, when our two countries signed the Interim Trade Partnership Agreement, seeking to provide duty-free and quota-free UK market access for Ghana Exporters and the 80% asymmetrical progressive preferential tariff reductions for British Exporters.

While we know that similar relations exist between the UK and individual African countries, we hope that the same relations with continental institutions will be cemented as well. Signs of engagement in this direction are evident as the first-ever UK-Africa Investment Summit was held in January 2020 to lay the foundation for new partnerships between the UK and Africa on trade and investment.

Ladies and Gentlemen, to conclude, within the last 45 minutes or so, I have put the challenges to Africa’s economic transformation in context and addressed the new direction in our quest to overcome the myriad challenges affecting our quest to transform our economies. I have outlined some of the ways Ghana has made progress in using digitalization to achieve economic transformation and the lessons therein for Africa’s own transformation. Africa can leap-frog many advanced economies in the area of digitalization because we are not burdened by legacy systems. It is also important to note that Ghana’s digitalization has been private sector driven.

Finally, I have touched on just a fraction of the many mutually beneficial opportunities that exist in a deepened UK-Ghana, UK-Africa relations. I do hope that in future, we will see even deeper UK-Ghana, UK-Africa relations.

I thank you for your attention.