INTRODUCTION

First Lady

Second Lady

Chief of Staff

Chairman of the NPP

General Secretary of the NPP Ministers of State

Members of Parliament

MMDCEs

National Executives

Regional and Constituency Executives CEOs and Heads of Institutions Tescon President and Executives Tescon Members

Friends from the Media

Ladies and Gentlemen

Good evening!

It is my pleasure and privilege to once again have the opportunity to address you at this important national conference. I would like to thank the organizers of the conference for the invitation to speak. Today, I want to address the issue of the State of the Economy.

The issues about national economies and how well individual countries are handling their respective economic situations appear to be the most important thing on people’s minds in recent times. From the man on the street to the business mogul, the food we eat, the clothes we wear, the shelter we seek or have, to the benevolence we extend to friends and family, the health of the economy is the foundational instrument. To bring this home, essentially the economy is what we feel in our pockets. I acknowledge that we are going through challenging time. This is the reality irrespective of the cause.

Not long ago, we had felt similar despair. The fear of losing our lives to a pandemic and the near halt to our economy as we battled to survive each day. Some years ago, also we had been confronted by very dire economic circumstances. The joblessness of our youth, years of lights out that adversely impacted on businesses and jobs, the disappointment of dealing with a collapsed national health insurance system and inability to access health care, the bane of the cash and carry system, a nearly collapsed national ambulance system, freeze on public sector employment, an almost collapsed banking sector and so on.

The economy was on the verge of collapse and a legacy of take or pay contracts saddled our economy with annual excess capacity charges of close to $1 billion. These were basically contracts to supply energy to Ghana way in excess of our requirements, but we were obligated to pay for the power whether we use it or not. We were confronted with a banking crisis. Not dealing decisively with it would have meant disaster for the economy as the entire banking system would have collapsed. In addition, not keeping up with the excess capacity payments would have meant throwing the country back into a new bout of dumsor.

The government of President Nana Addo Dankwa Akufo Addo put in a lot of effort to turn things around from what the situation was used to be at the time we came into office in 2017. We had only one mission: Stop the decline and make things better.

Together as a country, we proceeded to fix the economy. We made great gains, and the records attest to this. Prior to the Coronavirus pandemic which has impacted all economies in the world, we stabilized the economy. We:

- reduced inflation

- doubled economic growth in our first three years

- reduced the rate of depreciation of the cedi. The average depreciation for 2017-2020 was the lowest for any first term government since 1992.

- reduced the fiscal deficit

- improved our external payments position.

- Reduced interest rates in line with declining inflation expectations.

- cleaned up the mess in the financial services sector that we inherited. We took decisive action to avoid the collapse of the financial sector, save the deposits of 4.6 million depositors and save jobs. Thousands of businesses would have collapsed if they had lost their deposits.

- We implemented our flagship programs such as Free SHS, Planting for Food and Jobs, IDIF, NABCO, IPEP, Zongo Development Fund, Restoration of teacher and nursing training allowances and

- We embarked on the digitalization of the economy.

The relatively strong performance of the economy, among other things, led to Ghana becoming the destination of choice for Foreign Direct Investments (FDI) in West Africa according to the 2019 World Investment Report by UNCTAD.

Unfortunately, the COVID-19 pandemic changed the economic circumstances of virtually every country in the world.

Today, our economy is witnessing rising prices of fuel, and virtually all commodities like bread, rice, sugar, sachet water, cement, iron rods, and so on. From Malata market through Abofour market, to Techiman Market, to Takoradi market circle, to Kpando and almost everywhere across the country, prices are on the rise.

In the first quarter of this year, we have also suffered a sovereign credit ratings downgrade by two rating agencies (Fitch and Moodys) and along with that, there has been a significant depreciation of the cedi between February and March of this year. These developments have come as a surprise to many Ghanaians and in the ensuing discussions, many questions are being asked about the state of the economy. These questions include:

TABLE 1: QUESTIONS

| 1. What has happened to the economic fundamentals? |

| 2. Why are the prices of goods and services increasing so fast? |

| 3. Why has the cedi depreciated so fast this year? |

| 4. Why has the fiscal deficit and debt stock increased so much? |

| 5. What projects and programs does government have to show for the higher debt stock? |

| 6. Are the government flagship programs like Free SHS, the cause of our current economic challenges? |

| 7. How about the promise to move the economy from a focus on taxation to a focus on production? |

| 8. Where is the new economy you promised to build? |

| 9. How has government tackled corruption? |

| 10. What has the government done to relieve the suffering of Ghanaians? And, |

| 11. How is the government solving the current economic challenges? |

Today, I will address these questions based on data and facts, I will admit where there are challenges and hopefully, we will all leave here with a better understanding of the state of the economy: where we have come from, where we are now and where we are headed.

THE ECONOMIC FUNDAMENTALS

Let’s examine the economic fundamentals. Are weak fundamentals the reason for our current economic challenges? What is the data saying about key variables like Inflation, interest rates, external sector performance, fiscal balance, debt stock, GDP, and the exchange rate? Our assessment will be based on the evolution of these variables over a period of time.

INFLATION

Ladies and Gentlemen, countries and economies throughout the world are experiencing severe challenges following the COVID-19 pandemic and the more recent Russia-Ukraine war. The pandemic, which started early 2020, resulted in the greatest economic depression in the world since the 1930s with most countries recording negative GDP growth. Supply chain disruptions and the rising price of oil, which went up to a high of over $130 this year, has resulted in major increases in the prices of fuel across the globe with petrol prices doubling in many countries. The highest petroleum prices can be found in Hong Kong, the Netherlands, Zimbabwe, Germany, Israel and the United Kingdom (Table2).

TABLE 2: Price Per Litre of Gasoline (Petrol) on 28th March 2022

| US $ | |

| Hong Kong | 2.87 |

| Netherlands | 2.51 |

| Zimbabwe | 2.35 |

| Germany | 2.27 |

| Israel | 2.25 |

| United Kingdom | 2.14 |

| Central African Rep | 2.01 |

| Ghana | 1.44 |

Source: www.globalpetrolprices.com

Furthermore, the global average cost of shipping a container has increased from $1446 in December 2019 to $9, 789 in February 2022 (an increase of 576%). This has dramatically increased the cost of shipping goods and therefore their prices on the market.

Food prices have also not been left out. The FAO Global Food Price Index increased from 95.1 at the end of 2019 to 140.7 in February 2022 (an increase of 48%). The increase in commodity prices has been exacerbated by the Russia Ukraine conflict. Russia and Ukraine together account for 30% of global wheat exports; the longer the conflict ensues, the greater will be the disruption to global food supplies. The conflict is also likely to slow down global growth.

According to the AfDB, the price of wheat has shot up by 62% since the war began, the price of fertilizer is up by 300%, and the price of maize is up by 36%.

Here in Ghana, some 60% of our total imports of iron ore and steel are from Ukraine; Russia accounts for some 30% of Ghana’s imported grains, 50% flour, and 39% of fertilizer.

So we are directly affected by the Russian-Ukraine war. Unfortunately, we do not know when it would be over.

The global increase in fuel prices is causing hardship in even the most advanced economies like the United States of America. (Please watch the video on the screen showing the exasperated reaction of a consumer in the USA to the petrol price increases ).

Global inflation is on the rise and many advanced economies like the UK and USA are experiencing their highest inflation rates in 30 and 40 years respectively. Africa’s largest oil producer, Nigeria, is experiencing fuel shortages, high food prices and power outages. President Biden has blamed COVID and Russia for the high prices. Food prices are rising sharply in Algeria and there are shortages. There are protests in Spain over the high fuel, food and electricity bills. In the UK, consumers are complaining about energy bills, higher taxes, water bill, higher national insurance, higher broadband charges and so on. The entire Eurozone is feeling the pinch of rising prices.

TABLE 3 : INFLATION % IN SELECTED COUNTRIES 2019 AND 2022

| COUNTRY | 2019(Dec) | 2022 (Feb) | Factor of Increase |

| USA | 1.81 | 7.9 | 4.3 |

| UK | 1.79 | 6.2 | 3.4 |

| NIGERIA | 11.4 | 15.7 | 1.37 |

| COTE D’IVOIRE | 0.81 | 4.6 | 5.68 |

| GHANA | 7.9 | 15.7 | 1.98 |

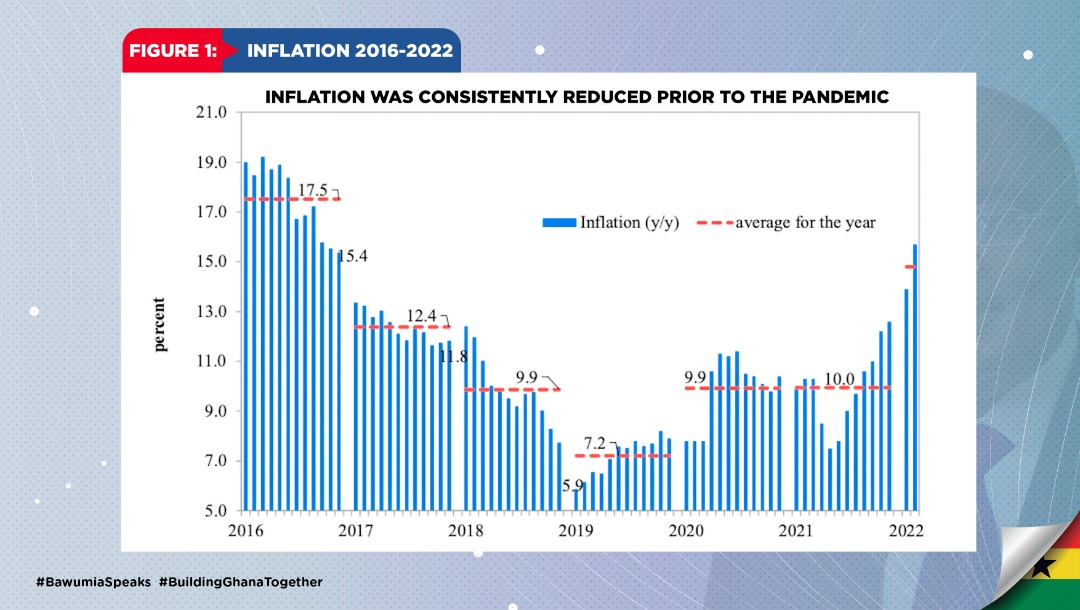

Indeed, the data (Table 3) shows that in the UK and US for example, inflation is accelerating at three to four times its rate in 2019 (before COVID). In Cote d’Ïvoire inflation is accelerating at five times its rate before COVID-19. In Nigeria and Ghana, inflation is accelerating at 1.3 to 2 times its rate before COVID-19. The path of inflation in Ghana has been similar to those of other countries following the COVID pandemic. Inflation had decline from an average of 17.5% in 2016 to an average of 7.2% in 2020. Since the pandemic, inflation has increased to an average of 10% in 2021. As at February 2022 inflation rose further to 15.7% as a result of global conditions, including a rise in crude oil and other commodity prices and the Russian-Ukraine conflict. It is important to note that between 2013 and 2016 inflation averaged 15.9%. Between 2017 and 2021 however, inflation has averaged 10.4%

notwithstanding the impact of COVID-19.

FIGURE 1: INFLATION 2016-2022

INTEREST RATES

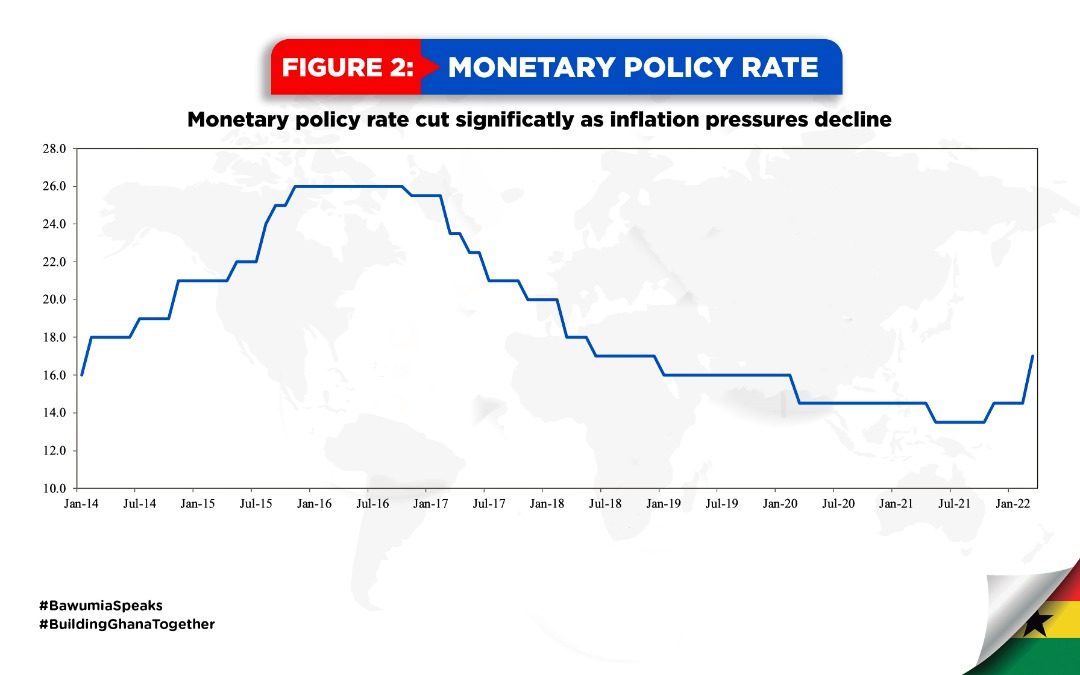

Before COVID-19, the steady disinflation process provided scope for significant monetary policy easing. The Bank of Ghana’s Monetary Policy Rate (MPR) was cut by a cumulative 11% between January 2017 and January 2021

(Figure 2).

FIGURE 2: MONETARY POLICY RATE

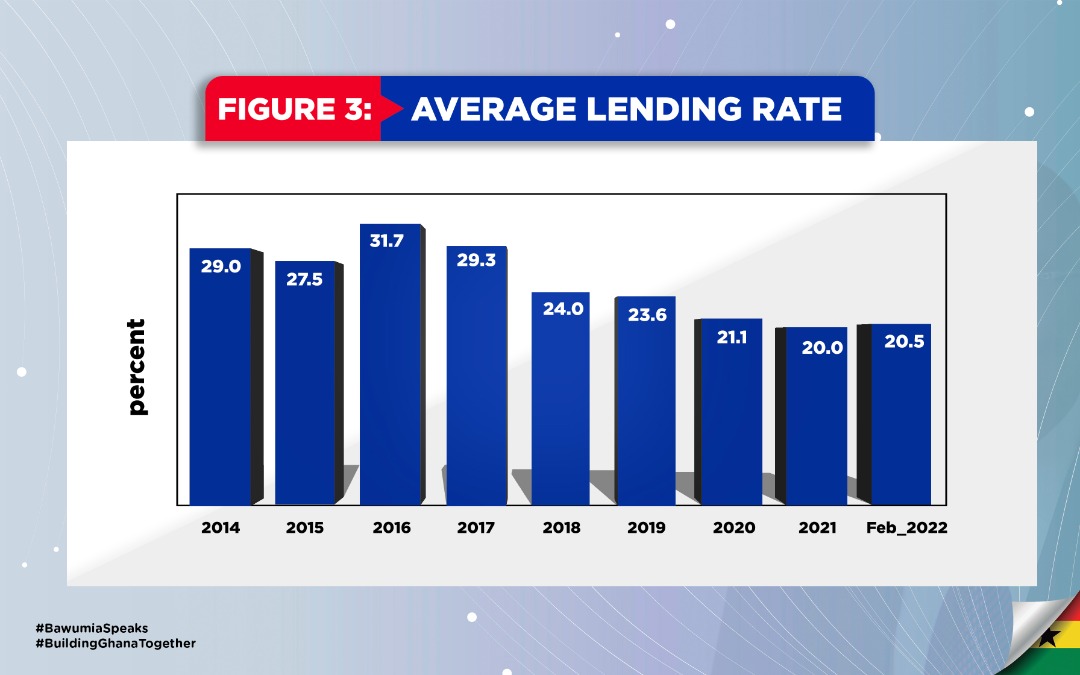

This translated into a reduction in short term interest rates, with the interest rate on the 91-day Treasury bill declining from an average of 21.2% between 2013 and 2016 to an average of 13.8% between 2017 and 2021. Lending rates have also fallen from an average of 28 percent between 2013 and 2016 to an average of 23% between 2017 and 2021 (Figure 3).

FIGURE 3: AVERAGE LENDING RATE

Notwithstanding COVID-19, interest rates are lower now than they were in the 2013 -2016 period.

In response to the recent increase in inflation, the Bank of Ghana has increased the policy rate by 2.5% from 14.5% to 17.0%.

External Sector Performance:

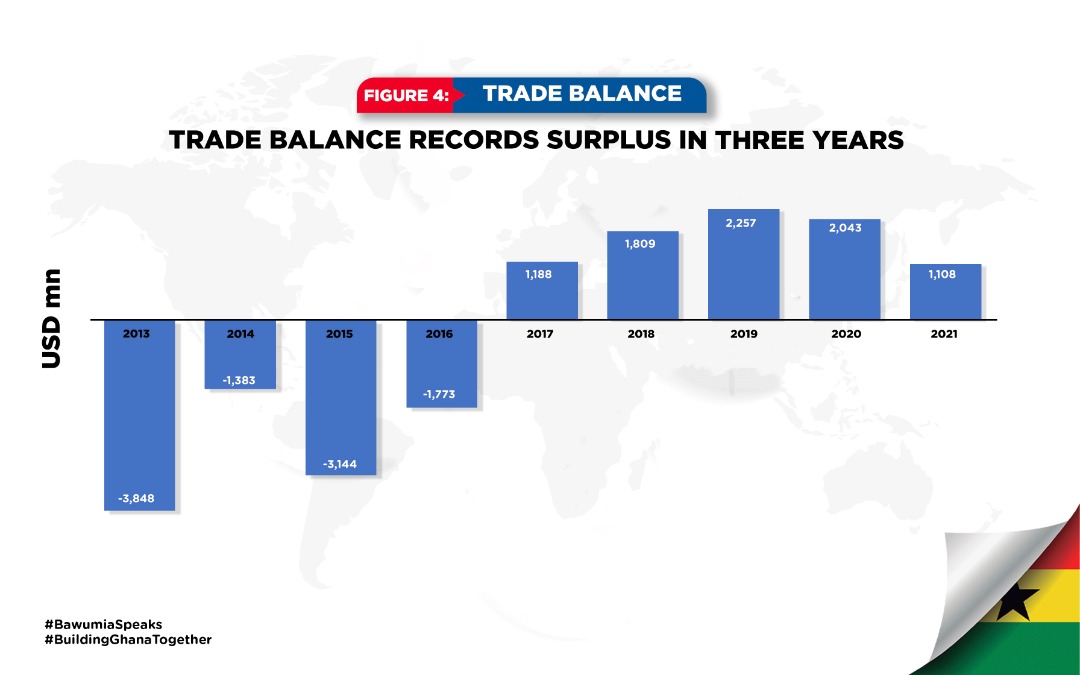

Ghana’s external payments position strengthened in the 2017-2021 period relative to the 2013-2016 years. For the first time in over 30 years, the trade balance (the difference between what we export and what we import) recorded a surplus for five successive years (Figure 4). The trade balance was in deficit between 2013 and 2016 but moved from a deficit of $1.7 billion in 2016 to a surplus of $1.1 billion in 2017, a larger surplus of $1.8 billion in 2018, and an even larger surplus of $2.2 billion in 2019. The impact of COVID-19 has seen a reduction of the surplus to $2.04 billion in 2020 and a further reduction to $1.1 billion in 2021. Nevertheless, this is still a much stronger performance than the trade deficit of $1.7 billion recorded in 2016 (which was one of the stronger performances in the 2013-2016 period.

FIGURE 4: TRADE BALANCE

Trade Balance records surplus in three years

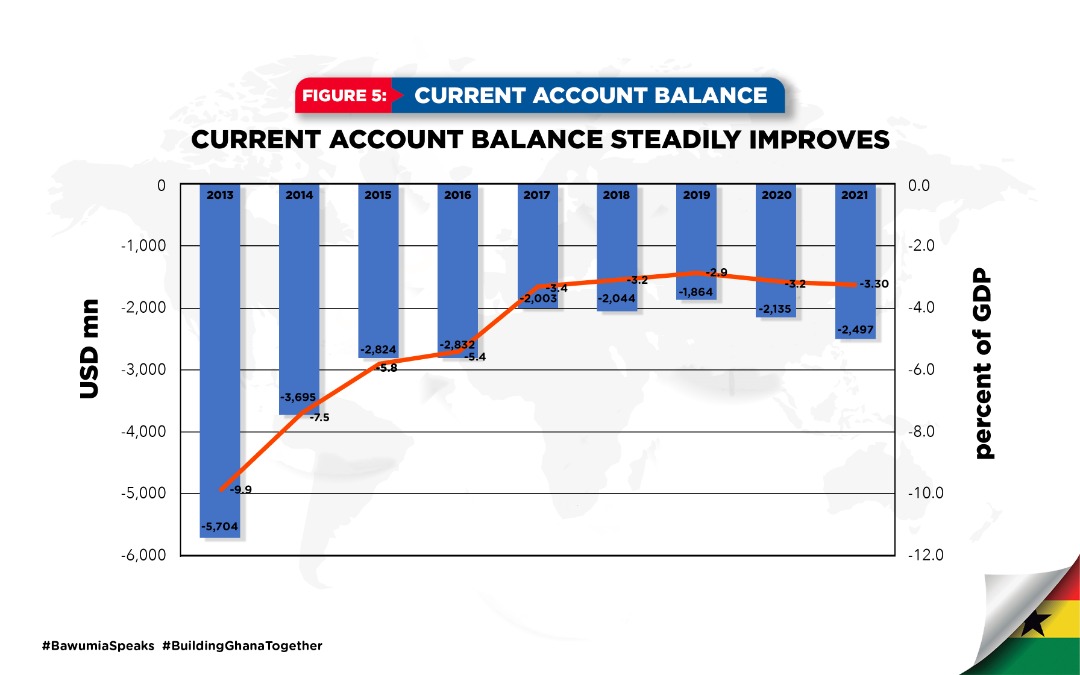

The positive trade balances resulted in a narrowing of the current account deficit as a percent of GDP between 2017 and 2019 but a subsequent widening of the deficit in 2020 and 2021 as a result of COVID-19. Notwithstanding COVID 19, the current account position in the 2017-2021 period is much stronger than that in the 2013-2016 period.

Figure 5: Current Account Balance

Current Account Balance steadily improves

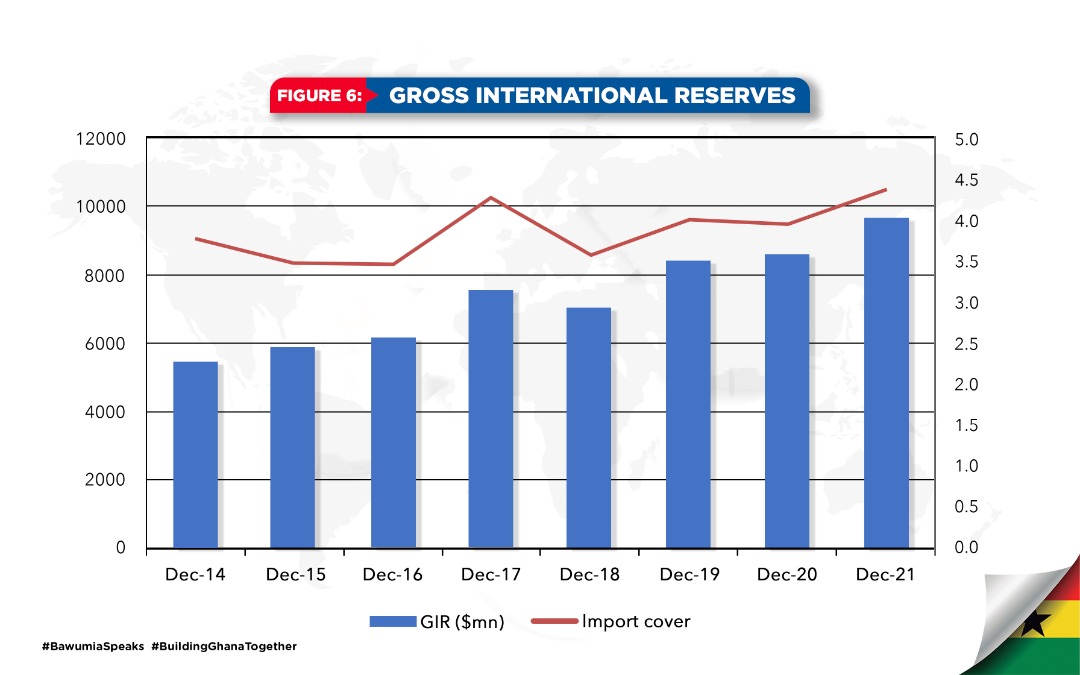

Improvements in current account performance and increased capital inflows have helped to boost Ghana’s international reserves. Figure 6 shows that Gross international reserves increased from $6.1 billion in 2016 to $8.4 billion (4.0 months of import cover) in 2019 and subsequently to $9.6 billion (4.4 months of import cover) at the end of 2021. By February 2022, Gross international reserves had marginally declined to $9.5 billion (4.3 months of import cover).

Figure 6: Gross International Reserves

FISCAL BALANCE AND DEBT

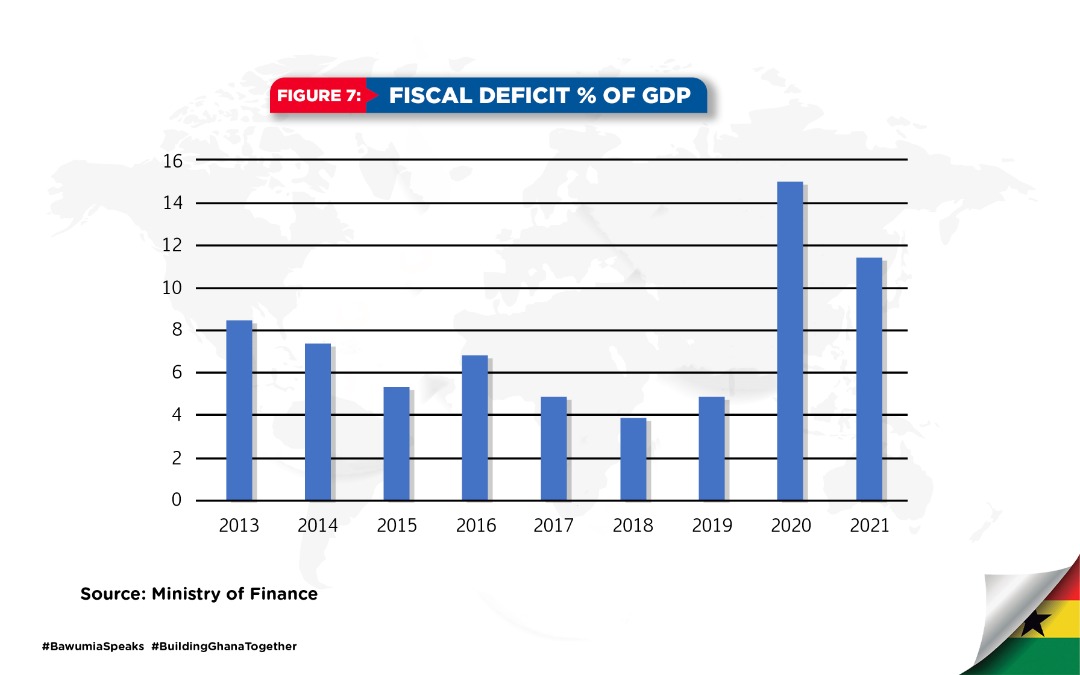

The developments in the fiscal balance show a remarkable and sharp dichotomy between the fiscal deficit (ie. the difference between government revenue and government expenditure) before the COVID-19 and after COVID-19.

The fiscal deficit between 2013 and 2016 averaged 7% of GDP.

Between 2017 and 2019 (before COVID-19), the fiscal deficit declined to an average of 4.5%. For the first time in a decade, Ghana recorded primary balance surpluses (for three years in a row). To sustain the path of fiscal discipline, parliament passed into law a Fiscal Responsibility Act that limits the fiscal deficit in any year to a maximum of 5% of GDP and requires a positive primary balance (that is our tax revenues should exceed all government spending—excluding debt service payments).

Then out of the blue the COVID-19 pandemic hit the world with devastating economic and health consequences. H.E President Nana Addo Dankwa Akufo-Addo and government had to take some quick and difficult decisions. The approach of the government was summed up in the President’s famous statement that “We know how to bring back the economy, but we don’t know how to bring back lives”. So, the government made a deliberate and conscious decision to protect the lives of Ghanaians and mitigate the suffering of households. Government therefore suspended the fiscal responsibility law to allow for increased expenditure.

Economic growth declined to 0.4% in 2020 and with it there was a decline in revenue mobilization of GHC 12 billion relative to target. At the same time expenditure was increased to engage more health personnel, provide tax relief packages, free electricity and free water, support to businesses, purchase of PPEs, etc. The combined impact of these factors as well as other expenditures resulted in an increase of the fiscal deficit from 4.8% of GDP in 2019 to 15% of GDP in 2020 and a subsequent improvement to 11.4% of GDP in 2021 (Figure 7).

Figure 7: Fiscal Deficit % of GDP

Source: Ministry of Finance

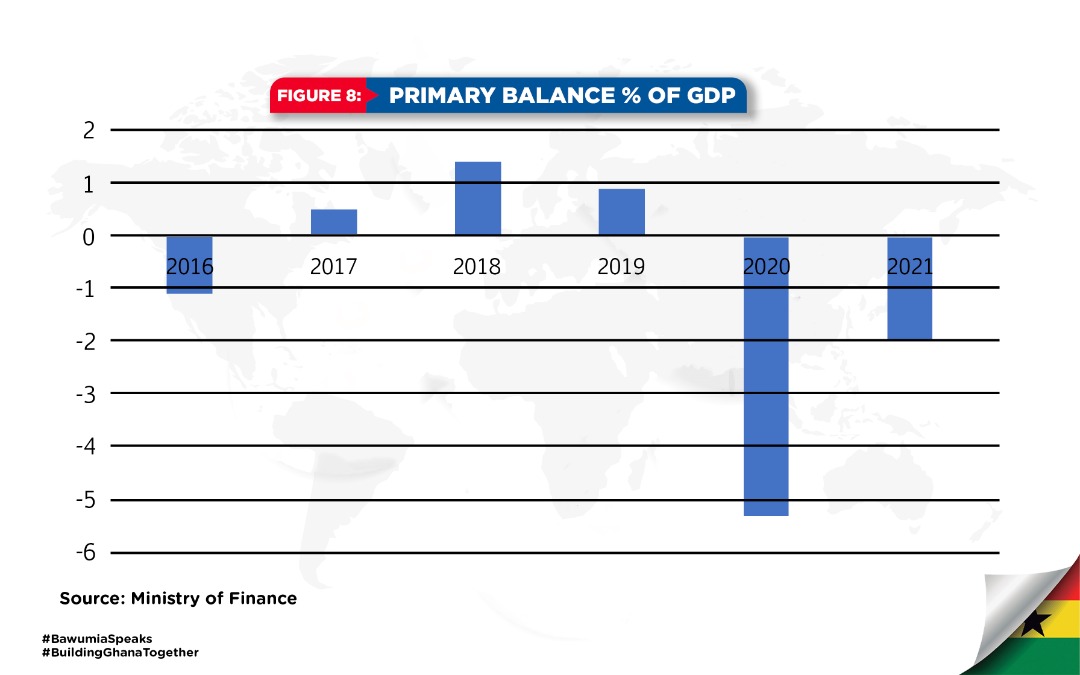

The primary balance also went from a surplus of 0.9% of GDP to a deficit of 5.3% of GDP in 2020 before narrowing to a deficit of 2% of GDP in 2021 (Figure 8).

Figure 8: Primary Balance % of GDP

Source: Ministry of Finance

I should note that Ghana has been acknowledged globally for doing an excellent job in the management of the COVID 19 pandemic and we have the strong leadership of the President for that. Deaths from COVID totaled 1,445 and the total case count today is 42. The expenditure to mitigate the impact of COVID was large but very important to save lives.

Some commentators and analysts have argued that COVID expenditures alone could not be the reason for the large increase in the fiscal deficit and the debt stock in 2020 and 2021. In fact, the data supports this view.

Comparing the fiscal deficit in 2020 and 2021 between Ghana and other sub-Saharan African countries (Table 4), it is clear that COVID-19 expenditures alone is not a sufficient explanation for the increase in the fiscal deficits in 2020 and 2021. The fiscal deficit/GDP in Ghana increased by three fold compared to 1.23 for Nigeria, and 1.02 Egypt, and 2.43 for Cote d’Ivoire.

TABLE 4: FISCAL DEFICIT/GDP % IN SELECTED AFRICAN COUNTRIES

| COUNTRY | 2019 | 2020 | Factor Increase |

| NIGERIA | 4.7 | 5.8 | 1.23 |

| EGYPT | 8 | 8.2 | 1.02 |

| COTE D’IVOIRE | 2.3 | 5.6 | 2.43 |

| GHANA | 4.8 | 15 | 3.1 |

Indeed, in addition to COVID-19 there were two major items of expenditure that are critical to understanding the evolution of the fiscal deficit and the debt stock: the Banking Sector Clean up and the Energy Sector Excess Capacity payments.

The data (Table 5) shows that the three items of expenditure cumulatively amounted to GHC 50.1 billion (the equivalent of some $7 billion), financed from borrowing. The Ministry of Finance estimates that the interest payment on this borrowing for the three items amounts to GHC 8.5 billion annually. This is about 23% of Ghana’s annual interest payments of GHC 37 billion.

TABLE 5: EXPENDITURE ON EXCEPTIONAL ITEMS 2018-2021

| Exceptional Items: Financial Sector Excess Capacity Charges COVID-19 | GHC BILLIONS 25 17 8.1 |

| Total | 50.1 |

Source: Ministry of Finance

To put the expenditure on these three items in perspective, it is important to juxtapose it against the total expenditure (releases) on some of the government’s key flagship projects, including Free SHS, One District One Factory, Planting for Food and Jobs, Development Authorities, Ghanacard, Zongo Development Fund, NABCO, and teacher and nursing trainee allowances. The data (Table 6) shows that the expenditure on these flagship programs over the five-year period between 2017 and 2021 amounted to GHC15.62

billion compared to the GHC 50.1 billion expenditure on the three exceptional items. The expenditure on the three exceptional items amounted to more than three times the expenditure on the flagship programs in the Table 6 below.

TABLE 6: EXPENDITURE ON FLAGSHIP PROJECTS

| FLAGSHIP PROJECT | EXPENDITURE (RELEASES) 2017-2021 GHC BILLIONS |

| FREE SHS | 5.3 |

| ONE DISTRICT ONE FACTORY | 0.472 |

| PLANTING FOR FOOD AND JOBS | 2.95 |

| DEVELOPMENT AUTHORITIES (IPEP) | 1.90 |

| NABCO | 2.1 |

| ZONGO DEVELOPMENT FUND | 0.17 |

| NIA (GHANACARD) | 1.1 |

| TEACHER TRAINEE ALLOWANCE | 0.77 |

| NURSING TRAINEE ALLOWANCE | 0.86 |

| TOTAL | 15.62 |

Source: Ministry of Finance

In fact, the annual interest cost of the borrowing for the exceptional items would pay for double the annual cost of all the flagship programs in Table 6. Of the three exceptional items, apart from renegotiating the terms of the IPP agreements, it is important that the receiver for the financial institutions retrieve the assets of the institutions to defray a significant portion of this GHC 25 billion debt.

THE DEBT STOCK

According to the World Bank, the attempt by governments across the world to protect livelihoods and stimulate their economies has meant higher fiscal deficits and debt levels globally. Sizable discretionary support, along with a sharp contraction in output and an ensuing fall in revenues, has led to a surge in government debt and deficits. In 2020, global government debt increased by 13 percentage points of GDP to a new world record of 97 percent of GDP. In advanced economies, it was up by 16 percentage points to 120 percent of GDP and, in emerging market developing economies by 9 percentage points to 63 percent of GDP.

TABLE 7: DEBT/GDP RATIO % IN SELECTED COUNTRIES 2019 AND 2021

| COUNTRY | 2019 | 2021 | INCREASE |

| USA | 108 | 120 | 12 |

| UK | 85.4 | 103.7 | 18.3 |

| NIGERIA | 29.1 | 35.7 | 6.6 |

| COTE D’IVOIRE | 37.9 | 50.21 | 12.3 |

| EGYPT | 84 | 91 | 7 |

| GHANA | 62.4 | 80* | 17.6 |

*Estimated

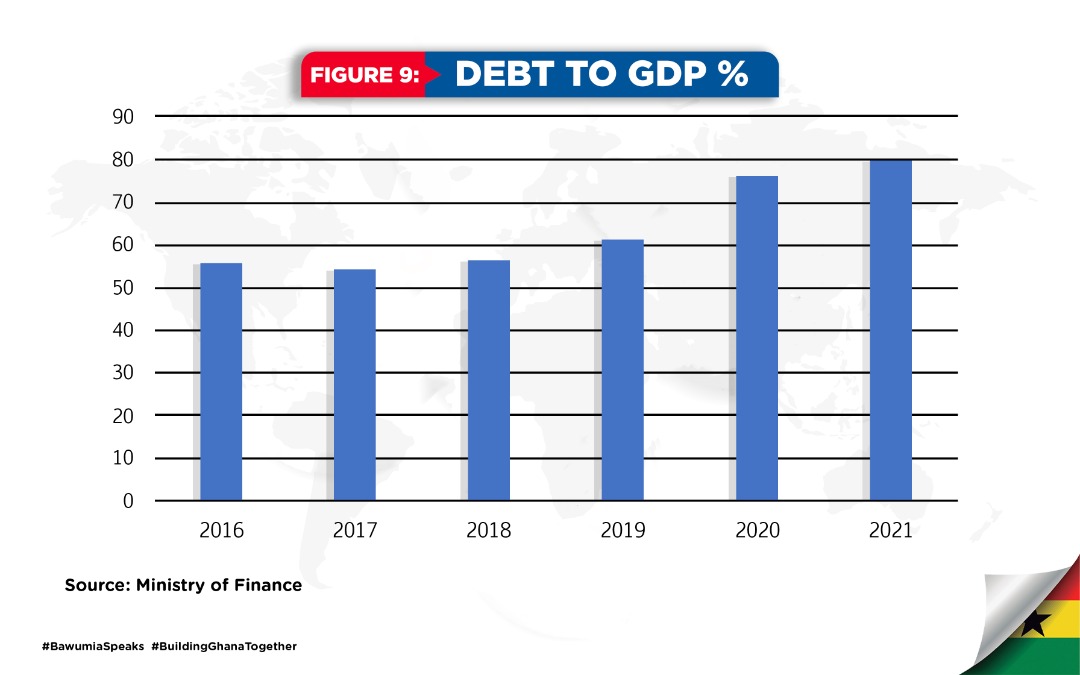

The data (Table 7) shows that the debt to GDP ratio after COVID-19 increased in the US, UK and Cote d’Ívoire by 12, 18 and 12.3 percentage points of GDP respectively. Table 8 shows that Ghana’s total debt stock has increased from GHC122.2 billion in 2016 to GHC 351.8 billion in 2022, an increase of GHC 229.6 billion. At the end of 2021, external debt amounted to GHC170 billion (38.7% of GDP) and domestic debt totaled GHC181.8 billion (41.4% of GDP)

Debt Stock in Millions of GH¢

TABLE 8: GHANA’S DEBT STOCK 2015 Prov. 2016 Prov. 2017 Prov. 2018 Prov. 2019 Prov. 2020 Prov. 2021 Prov.

External Debt 59,836.7 68,762.1 75,777.6 86,202.5 112,747.7 141,796.8 170,009.8 Domestic Debt 40,322.1 53,403.4 66,769.1 86,899.7 105,481.2 149,833.9 181,777.2 Total Debt 100,158.8 122,165.5 142,546.6 173,102.2 218,228.9 291,630.7 351,787.0

Debt to GDP

2015 Prov. 2016 Prov. 2017 Prov. 2018 Prov. 2019 Prov. 2020 Prov. 2021 Prov.

External Debt 32.6% 31.3% 28.8% 27.9% 31.6% 37.0% 38.7% Domestic Debt 22.0% 24.3% 25.4% 28.2% 29.6% 39.1% 41.4% Total Debt 54.6% 55.6% 54.2% 56.1% 61.2% 76.0% 80.1%

Estimated Debt to GDP ratio updated for strong 2021 growth 77.5% estimated real gdp growth 5.3 estimated deflator 12.5 Implied nominal GDP (Ghs bn) 454,115.4

Source: Bank of Ghana

Figure 9: Debt to GDP %

Source: Ministry of Finance

Between 2019 and 2021, Ghana’s debt to GDP ratio increased by 17.6 percentage points of GDP.

It should be noted that without the GHC 50.1 billion debt for the three exceptional items (COVID-19, Financial Sector and Energy), Ghana’s debt to GDP would be about 68% instead of the 80% currently. Because of COVID-19, GDP growth was virtually zero in 2020 and this is also bound to increase the debt to GDP ratio other things being equal with a lower base.

Now to the question of what projects and programs government have to show for the higher debt. Some loan agreements underpinning the external debt stock are listed in Table 9 and provide descriptions of the projects that have been, are being or will be financed with the loans. The projects include:

TABLE 9: LOAN AGREEMENTS SIGNED SINCE 2017 –

| NO | PROJECT |

| 1. | Construction of a University and Related Dormitory Facilities in Somanya, Eastern Region |

| 2. | Pokuase Interchange |

| 3. | Tema-Mpakadan Railway |

| 4. | Greater Accra Sustainable Sanitation and Livelihood Improvement Project |

| 5. | Additional Financing for Sustainable Rural Water and Sanitation Project |

| 6. | Development of Kumasi Airport Phase 2- Commercial Facility Agreement |

| 7. | Development of Kumasi Airport (Phase 2)- UKEF Facility Agreement |

| 8. | Additional Financing for the Secondary Education Improvement Project |

| 9. | Upper East Region Water Supply Project |

| 10. | Savanah Zone Agricultural Productivity Improvement Project (SAPIP) |

| 11. | Polytechnics, Technical and Vocational Training Centres Upgrading Projects of Ghana |

| 12. | Rural Entreprise Programme (REP) |

| 13. | Services for the Enhancement of Nationwide Water Network Management |

| 14. | Enhancement of Road Safety- Turnkey Implementation of Photovoltaic Based Street Lighting Programme- Phase II |

| 15. | Improving Access to Quality Health Care in Western Region of Ghana |

| 16. | Obetsebi Lamptey Interchange |

| 17. | Establishing a Deposit Protection Scheme in Ghana |

- Upgrading and Enhancement of Technical and Vocational Training Centres- Phase 2

| 19. | Ghana Transport Sector Improvement Project |

| 20. | Construction of 7 Bridges in the Northern Region of Ghana |

| 21. | Ghana Commercial Agriculture Project- Additional Financing |

| 22. | 22. Establishment of the university of Environment and Sustainable Development project |

| 23. | Public Sector Reform for Results Project |

| 24. | Ghana Energy Sector Transformation Initiative Project |

| 25. | Financial Sector Development Project |

| 26. | Ghana Secondary Cities Support Program |

| 27. | Tourism Development Project |

| 28. | Tamale International Airport- Phase 2 |

| 29. | Completion and Equipping of Bekwai District Hospital |

| 30. | Redevelopment and Modernisation of Kumasi Central Market and its Associated Infrastructure-PhaseII |

| 31. | Productive Safety Net Project |

| 32. | Modernization and Equipping of Selected Health Facilities (Tetteh Quarshie Memorial, Kibi, Aburi and Atibie Hospitals) |

| 33. | Supply of 300 sets of Global Multipurpose Mini Tractors and 220 Compact (CABRIO I and II) tractors |

| 34. | Expansion of the University of Ghana Hospital- Phase II |

| 35. | Ghana Incentive-Based Risk-Sharing System for Agricultural Lending |

| 36. | Design, Fabrication, Supply and Installation of 50 No. Composite Bridges and Related Civil Works |

| 37. | Rehabilitation and Upgrading of Potable Water System in Yendi |

| 38. | Strengthening of Agricultural and Mechanization Services Centres (AMSECs) in Ghana |

- Execution and Completion of the Military Housing project for the Ministry of Defence

| 40. | Overall upgrading and modernization of the vocational education system in Ghana |

| 41. | Additional Financing for the Rehabilitation and Expansion of the Bolgatanga Regional Hospital Project |

| 42. | Rehabilitation of Dome-Kitase Road Project (procurement ongoing) |

| 43. | Support to Basic Education in Five (5) Regions Project |

| 44. | First Africa Higher Education Centers of Excellence for Development Impact Project |

| 45. | Cocoa Sector Institutional Support Project (COSISP) |

| 46. | Financing of Kumasi Airport Redevelopment- Phase 3 |

| 47. | Modernisation of Konfo Anokye Teaching Hospital project |

| 48. | Term Loan Facility- Integrated National Security Communication Enhancement Network Project- Phase 2 |

| 49. | Integrated National Security Communications Enhancement Network Project- Phase II |

| 50. | Design, Construction and Commissioning of a potable water infrastructure Project in Tamale, Northern Region, Ghana |

| 51. | Kpong Generating Station Retrofit- Additional Financing |

| 52. | Savannah Investment Programme (SIP) |

| 53. | Strategic Climate Fund-Forest Investment Program |

| 54. | Ghana Economic Transformation Project |

| 55. | Ghana Accountability for Learning Outcomes Project |

| 56. | Greater Accra Resilient and Integrated Development Project |

| 57. | Eastern Corridor Road Development Programme- Phase 1 |

| 58. | Eastern Corridor Dev’t Prog. (Phase I) |

- Ghana COVID-19 Emergency Preparedness and Response Project

| 60. | Harmonizing and improving statistics in West Africa Project (HISWA) |

| 61. | Construction of 14 Pedestrian Bridges |

| 62. | Ghana Rural Telephony and Digital Inclusion Project |

| 63. | Construction of the Takoradi Market |

| 64. | Expansion and Rehabilitation of Keta Water Supply System Project |

| 65. | Elmina Fishing Port Rehabilitation and Expansion Project |

| 66. | Design, Construction and Equipping of Eastern Regional Hospital at Koforidua- Phase 1 |

| 67. | Strengthening Institutional Capacity for Domestic Resource Mobilization and Economic Mgt Proj. |

| 68. | Four (4) Constituencies (5 Districts) Water Supply Project Phase 3 |

| 69. | Construction of the Tema-Aflao road Project- Phase 1 |

| 70. | Streets of Accra- Phase 2 |

| 71. | Engineering, procurement and construction of drinking water facilities in Wenchi |

| 72. | Rural communities and small towns water supply project- Aqua Africa |

| 73. | Self-Help Electrification Programme in Five Regions in Ghana- Phase II |

| 74. | Outgrower Value Chain Fund-Phase III |

| 75. | Ghana Jobs and Skills Project |

| 76. | Obetsebi Lamptey Interchange and Ancillary works Project- Phase 2 |

| 77. | Streets of Tamale- Phase 2 |

| 78. | e-Transform Ghana project- Additional Financing |

| 79. | Ghana Development Finance Project |

- Greater Accra Metropolitan Area Sanitation and Water Project- Additional Financing

| 81. | Ghana COVID-19 Emergency Preparedness and Response Project- Additional Financing |

| 82. | Construction of 12 polyclinics in Ashanti, Eastern, Greater Accra and Ahafo Regions |

| 83 | Design, Construction, Equipping and Furnishing of a Urology and Nephrology Centre of Excellence at Korle Bu Teaching Hospital |

| 84. | Emergency Support to Rural Livelihoods and Foods Systems Exposed to Covid-19 (Esrf) |

| 85. | Construction of Paa Grant Interchange and other roads in Sekondi and Takoradi Township- Phase 1 |

| 86. | Construction of Tema and Nkoranza hospitals and central medical stores in Ghana |

| 87. | Design, fabrication and supply of 89 clear-span two lane rapid-response bridges |

| 88. | Bechem-Techiman-Akomadan and Tarkwa-Agona Nkwanta Road Project (ATI) |

| 89. | Rehabilitation and equipping of La General hospital |

| 90. | Construction and equipping of Shama District Hospital |

| 91. | Renewable Energy and Energy Efficiency Programme |

| 92. | Techiman Water Supply Project |

| 93. | Supply and Installation of Medical Equipment Project |

| 94. | Ghana Integrated Financial Management Information System (GIFMIS) ICT Upgrade Project |

| 95. | COVID-19 Emergency Response Program |

| 96. | Supply and installation of integrated e-learning laboratories in senior high schools |

| 97. | Supply and installation of integrated e-learning laboratories in senior high schools-State to State Loan |

| 98. | Upgrading and enhancement of 2 technical Institutes and 4 technical high schools- Phase III |

- Affordable Agricultural Financing for Resilient Rural Development Project (The “AAFORD, Accra”)

| 100. | Supply of armoured vehicles for the Ministry of Defence |

| 101. | Design and build contract for Tamale to Walewale Road (Savelugu to Walewale)- Phase 1 |

| 102. | Construction of University of Environment and Sustainable Development, Somanya, Eastern Region Phase 2 |

| 103. | Supply of 45 intercity buses to the Ministry of Transport |

| 104. | Supply of 45 intercity buses to the Ministry of Transport- State to State Loan |

| 105. | Partial Reconstruction of Selected Roads in Accra and Kumasi |

| 106. | Facility for the financing of hospitals in Ghana |

| 107. | Redevelopment and Modernization of the Kumasi Central Market (Tranche 2 of Phase 2) |

| 108. | Purchasing of 112 ambulance vehicles |

| 109. | Construction of section one of the Bolgatanga Bawku Pulimakom Road Project |

| 110. | Financing of the construction of sections of the western railway line |

| 111. | Design and construction of Ashaiman Roundabout Akosombo Junction (upgrading of Eastern Corridor Road- Lot 1) |

| 112. | Ghana COVID-19 Emergency Preparedness and Response Project |

| 113. | Ghana Productive Safety Net Project 2 |

| 114. | Rehabilitation and remodelling of the existing Effia Nkwanta regional hospital and construction of Agona Regional hospital. |

115.Establishment of 9 State of the Art Technical and Voc. Training Centers in Ghana

| 116. | Design, Construction and Commissioning of Potable Water Infrastructure Project in Tamale |

| 117. | Design, Construction and Equipping of New 400-Bed Obstetrics and Gynaecology Dept. at Korle-Bu |

Source: Ministry of Finance

OTHER PROJECTS

There are so many other projects going on such as.

• Flowerpot Interchange

- Adjiringano Overpass

- La-Beach Road

- Anwiankwanta-Obuasi

- Borae Junction- Kpandai

- Kpando-Kwamekrom

- New Abirem-Ofoasekuma

- Oseim-Begoro

- 50 Czech Bridges

- Twifo Praso Bridge

- 4 Belgium Bridges

- Bridge over river Pra on Kushea-Hwidiem

- Tamale- Yendi (Mobilized to Site)

- Yendi-Zabzugu-Tatale (Mobilized to site)

- Kumasi Road and Drainage Extension Project – • James Town Fishing Habour

- Fish Landing Sites

o Axim

o Dixcove

o Moree

o Senya Breku

o Gomoa Fete

o Winneba

o Mumford

o Jamestown

o Teshie

o Keta

- Sea Defence Projects

o Dansoman

o Axim

o Amanful Kumah

o Anomabu

o Elmina

o Cape coast

o Dixcove

o Komenda

o Aboadze

o Ningo Prampram

- Ongoing construction of ten (10) 5,000-seater Youth and Sports Centres of Excellence in ten regions of the country are at various stages of completion. • Kaneshie, (Greater Accra)

- Ho (Volta)

- Koforidua (Eastern)

- Axim (Western)

- Nyinahin (Ashanti)

- Dunkwa On-Offin (Central)

- Dormaa (Bono)

- Navrongo (Upper East)

- Yendi (Northern)

- Wa (Upper West)

- Railways

o Kojokrom-Manso

o completed rehabilitation of Accra – Tema (30 km), o Kojokrom – Tarkwa (56 km) narrow gauge lines.

- Equipment and retooling of 52 technical institutes • 80 Warehouses

- Barracks Regeneration Project – housing at all garrisons

- 15 Forward Operating Bases under construction • 320 Housing units at the National Police training School

- Damango Water Supply Project

- Sunyani Water Supply Project

- Sekondi Takoradi Water Supply Project

- Sunyani Airport

- Completion and equipping of 750-bed KATH maternity and Childrens block

- Agenda 111 hospitals

MOVING FROM A FOCUS ON TAXATION TO A FOCUS ON PRODUCTION

Ladies and gentlemen, as part of measures to get the economy back on track, improve domestic revenue mobilisation and improve efficiency, government increased a number of taxes.

These include:

- The extension of the National Fiscal Stabilisation Levy and the Special Import Levies from 2020 to 2024 • Imposition of a luxury vehicle levy which was later abolished

- Increase in CST from 6% to 9% and subsequently reduced from 9% to 5%.

- Increase in National Health Insurance Levy from 2.5% to 3.5%

- Sanitation and pollution Levy of 10 pesewas on the price of a liter of petrol/diesel.

- Energy sector recovery levy of 20 pesewas per liter on petrol/diesel.

- A financial sector clean-up levy of 5% on the profit before tax of banks.

- The introduction of an E-Levy of 1.5% on electronic financial transactions.

However, it is important to point out that notwithstanding the revenue challenges we inherited at the time of taking office, we took the decision to reduce taxes in the economy. We were aware that our decision to reduce the taxes could worsen our revenue challenges in the short term, but we were of the firm conviction that this would spur growth and increase tax revenues in the medium to long term. In fulfillment of our manifesto promise to move the economy from a focus on taxation to a focus on production we have thus far reduced or abolished at least 18 separate taxes and levies and most of them were manifesto promises (Table 10). No such broad-based reduction in taxes has been implemented by any government since independence.

TABLE 10: TAXES REDUCED OR ABOLISHED

| 1. | Abolished the 5% VAT/NHIL on real estate sales |

| 2. | Abolished the 17.5% VAT/NHIL on selected imported medicines, that are not produced locally |

| 3. | Abolished the 17.5% VAT/NHIL on financial services |

| 4. | Abolished import duty on the importation of spare parts. |

| 5. | Abolished 1% special import levy |

| 6. | Abolished 17.5% VAT on domestic airline tickets |

| 7. | Abolished Levies imposed on Kayayei by local authorities |

| 8. | Reduced import duty for some goods and vehicles |

| 9. | Abolished excise duty on petroleum |

| 10. | Provided full corporate tax deduction for private universities who plough back 100% of profits into the university |

| 11. | Reduced National Electrification Scheme Levy from 5% to 3% |

| 12. | Reduced Public Lighting Levy from 5% to 2% |

| 13. | Reduced special petroleum tax rate from 17.5% to 13% and introduced specific rates |

| 14. | Replaced the 17.5 VAT/NHIL rate with a flat rate of 3 % for traders |

| 15. | Granted Capital Gains Tax Exemption on stocks traded on the Ghana Stock Exchange or publicly held securities approved by the SEC |

| 16. | Abolished the income tax on mutual fund and unit trust schemes |

| 17. | Abolished income tax on REIT |

| 18. | Reduced withholding tax for gold exporters from 3% to 1%. |

Source: Ministry of Finance

Despite these tax reductions, the data shows that revenue collection in nominal cedi terms has increased by 25% annually since 2017.

Beyond these measures, government focused on production in the real sector.

Virtually every government in our history has noted the need for Ghana to change the structure of the economy through diversification and by shifting from the focus on the production of raw materials to value addition. This is a key pillar of Nana Akufo-Addo’s Ghana Beyond Aid agenda. To accomplish this, Government has implemented the following programmes:

- Planting for Food and Jobs to increase agricultural output for agro processing and food sufficiency. The results have been remarkable, with a significant increase in food production.

- The Tono dam, and the Left and Right banks of Kpong dam have been rehabilitated to provide 13,190 hectares of additional irrigable land for rice and vegetable cultivation.

- 80 warehouses have been constructed with a combined storage capacity of 80,000 MT to provide storage and reduce post-harvest losses.

- Reforms in the cocoa sector, including hand pollination, have resulted in the highest ever cocoa production (1,047,385 tonnes) recorded in Ghana during the 2020/2021 cocoa season.

- The “One-District-One-Factory” policy has taken off with a significant impact on the manufacturing sector. 106 factories have been completed and are operational, and 148 factories are under construction. This represents the largest number of factories established under a government program since independence.

- The facilitation of the growth of an Automotive Industry is on course:

o Volkswagen, Suzuki, Sino Truck, Peugeot, and Toyota, and recently Nissan have all established assembly plants in Ghana. KIA, Hyundai and Renault are also on course to start production in Ghana this year.

o Kantanka automobiles is benefiting from the same incentives

- We have started the process of building the integrated bauxite and aluminium industry. The partner for the project (Rocksure International), a wholly owned Ghanaian company, has been selected and has already started work to develop the Nyinahin-Mpassaso hills. The Minerals Resource Estimate to confirm the quantity and quality of the bauxite will be undertaken this year after which the refinery design will follow for the establishment of the aluminum refinery. Ghana has waited for this since independence and with visionary leadership, sound planning and by the Grace of God it is finally happening.

- Government, through Exim Bank, has also committed $60 million to supporting local pharmaceutical companies. 75%% of the approved amount has been released to various pharmaceutical companies.

Changing the structure of our economy through diversification and value addition will not happen overnight. However, it remains a major pre-occupation of the government because it is our pathway to reduce import dependency, expand the economy, create jobs, increase exports, and support the value of our currency.

How has this shift in focus to production manifested in GDP growth?

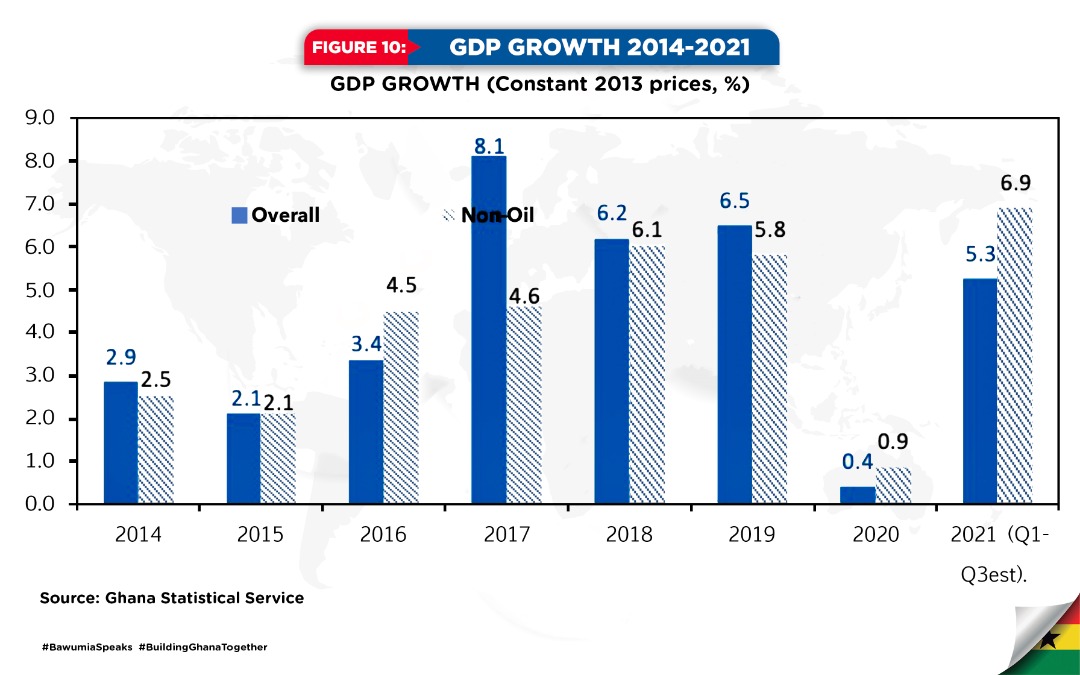

GDP GROWTH

After a period of sluggish and declining growth, real GDP growth picked up from 3.4% in 2016 to an average of 6.9% between 2017 and 2019 (Figure 10). The onset of COVID-19 in 2020 however, resulted in a sharp decline in GDP growth to 0.4% (many countries in the world recorded negative growth). The resilience of the economy manifested in 2021 with a pickup of real GDP growth from 0.4% in 2020 to a projected 5.3% in 2021, with the non-oil sector projected to grow at 6.9% in 2021. The average rate of GDP growth for 2017-2021 (including COVID-19 period) was 5.3%. compared to an average rate of growth of 3.0% between 2013 and 2016. Therefore, even with COVID-19, the growth of the economy is fundamentally stronger than it was in the 2013-2016 period.

FIGURE 10: GDP GROWTH 2014-2021

Source: Ghana Statistical Service

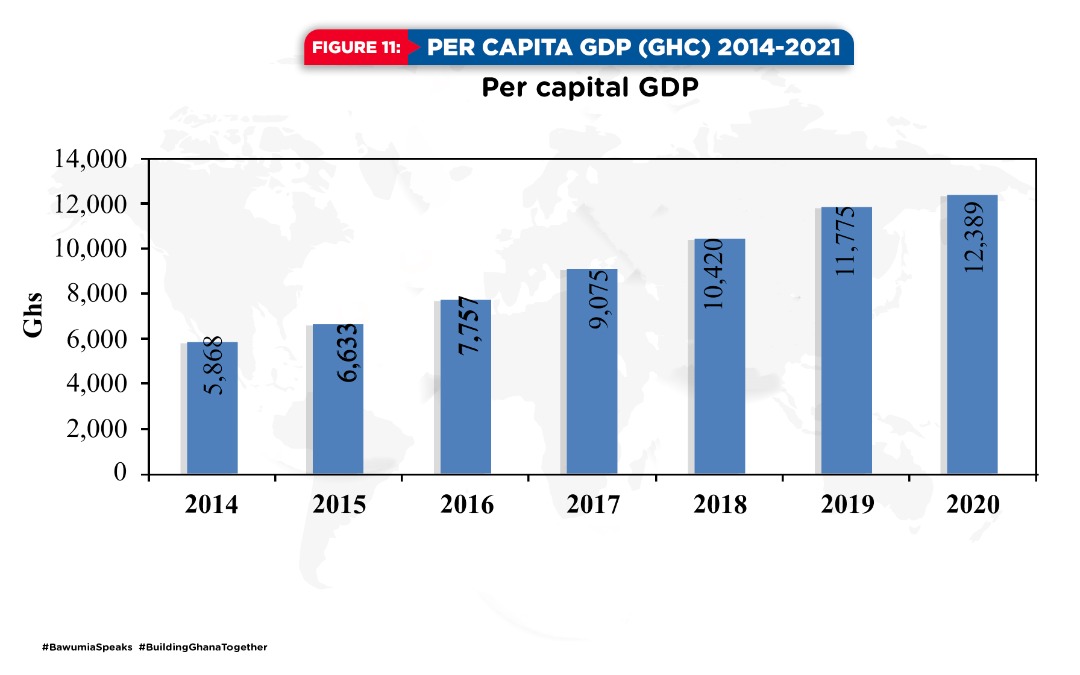

In per capita terms GDP per capita (that is total income per population) has continued to increase from GHC 7,757 in 2016 to GHC12,389 in 2020 (notwithstanding COVID-19). This represents an increase in GDP per capita by some 60% since 2016 (Figure 11)

FIGURE 11: PER CAPITA GDP (GHC) 2014-2021

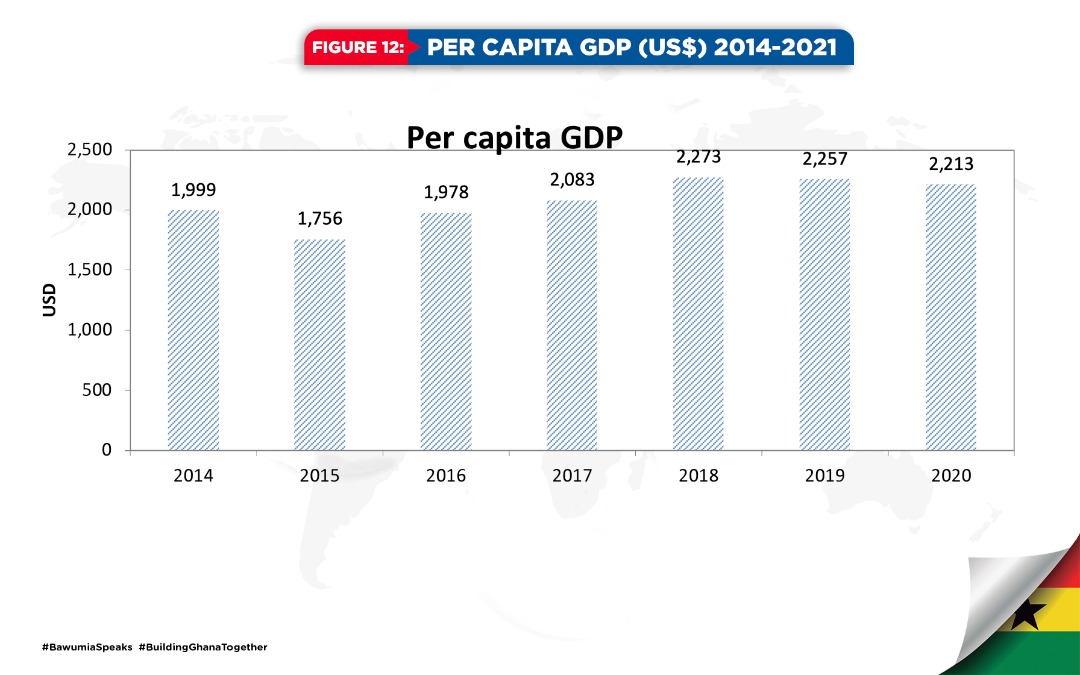

In US dollar terms, GDP per capita increased from US$1978 in 2016 to $2213 in 2020 with COVID-19 (Figure 12).

FIGURE 12: PER CAPITA GDP (US$) 2014-2021

FIGURE 13: SECTORAL GDP GROWTH 2014-2021

Source: Ghana Statistical Service

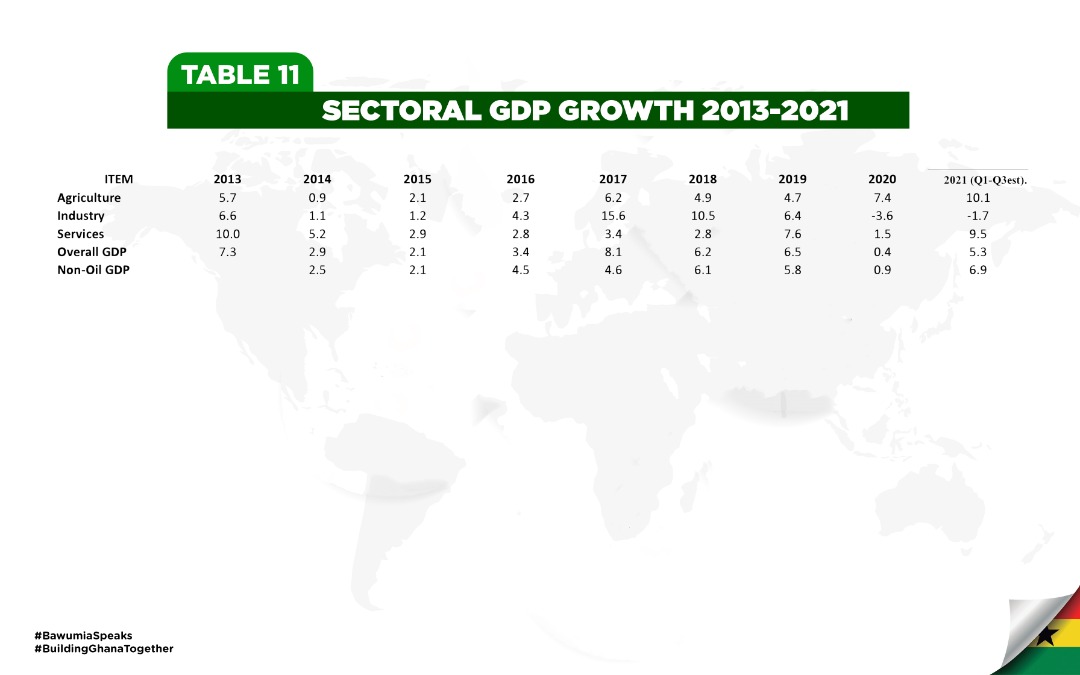

TABLE 11: SECTORAL GDP GROWTH 2013-2021

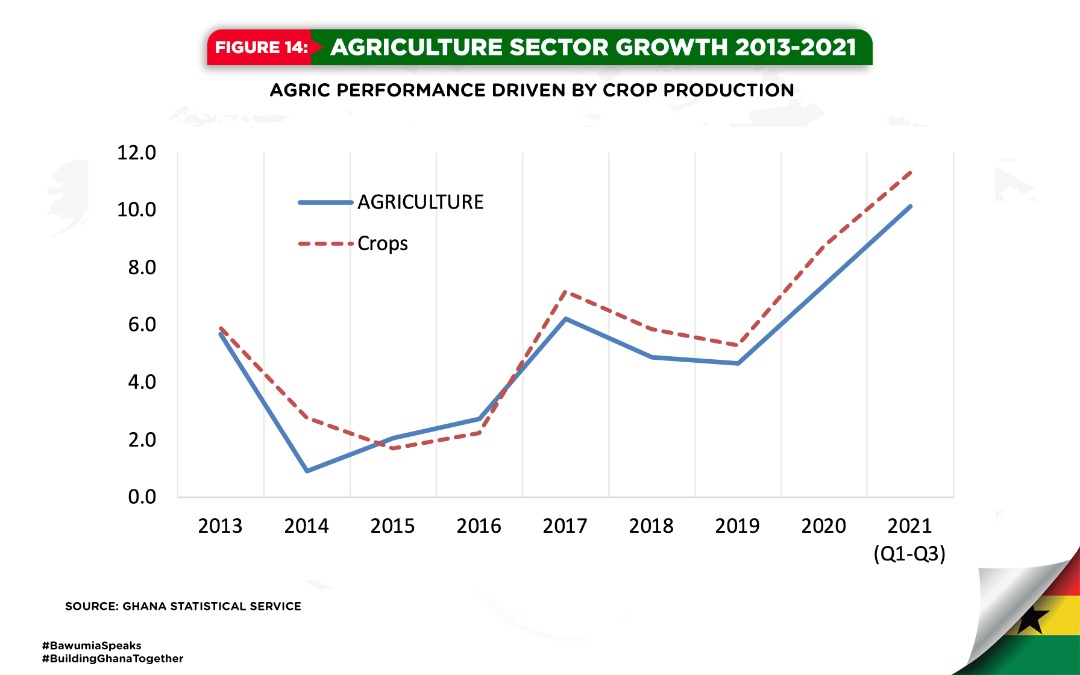

Table 11 and Figure 13 show that the Agricultural sector has seen a major increase in output since 2016, increasing from an average growth of 2.85% between 2013 and 2016 to an average of 5.8% between 2017 and 2020 (double the 2013- 2016 average) as a result of the success of the planting for food and jobs program. The data for the first three quarters of 2021 indicates a massive growth of 10.1% in the agricultural sector (Figure 14).

FIGURE 14: AGRICULTURE SECTOR GROWTH

2013-2021

Source: Ghana Statistical Service

Growth in the industry sector also saw a significant improvement prior to COVID-19. Between 2013 and 2016, industry recorded an average growth of 3.3% (Table 11). Between 2017 and 2019, industrial growth increased to an average of 10.8%. With the onset of COVID-19, industry growth declined to -3.6% in 2020 and -1.7% in 2021. Between 2017 and 2020 the industry sector grew by 7.2%. which is more than double the growth recorded in the 2013- 2016 period.

Growth in the service sector between 2013-2016 averaged 5.2% (Table 11). Prior to COVID-19, service sector growth increased to an average of 7.3% (2017-2019). Growth however declined to 1.5% in 2020 to bring the average rate of growth for the 2017-2020 period to an average of 5.85%. There has however been a significant pickup in growth by 9.5% for the first three quarters of 2021.

In summary, notwithstanding COVID-19, the agricultural sector is growing at double the rate of the 2013-2016 period, the industry sector is growing at double the rate of the 2013- 2016 period and the service sector has recorded a higher average growth than in the 2013-2016 period The growth fundamentals of our economy are therefore strong and resilient.

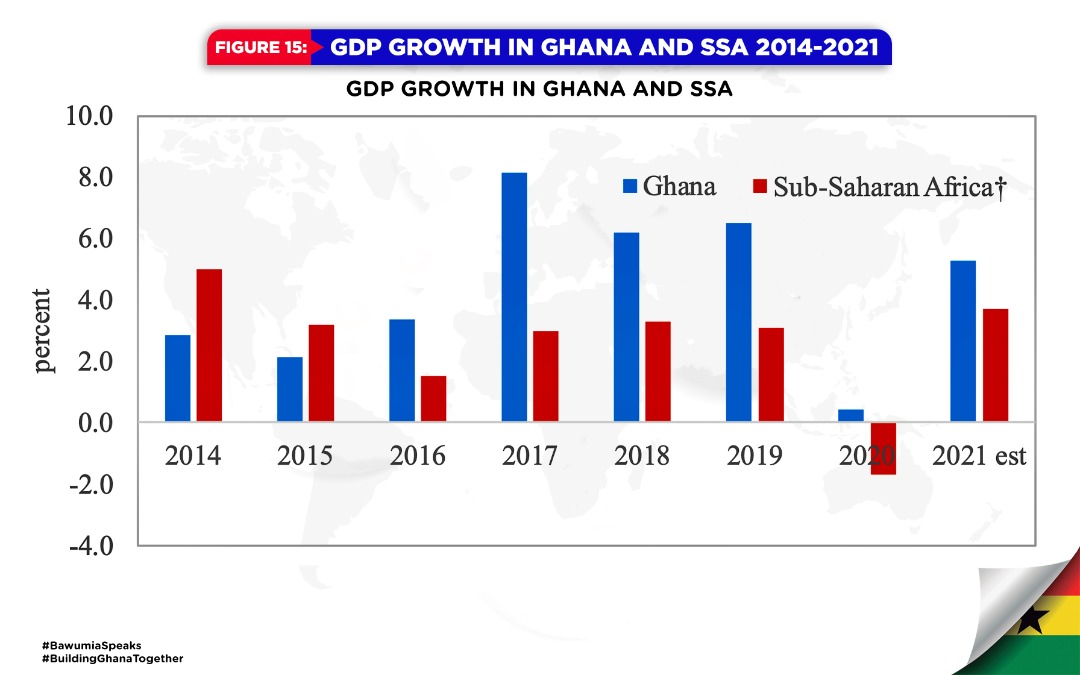

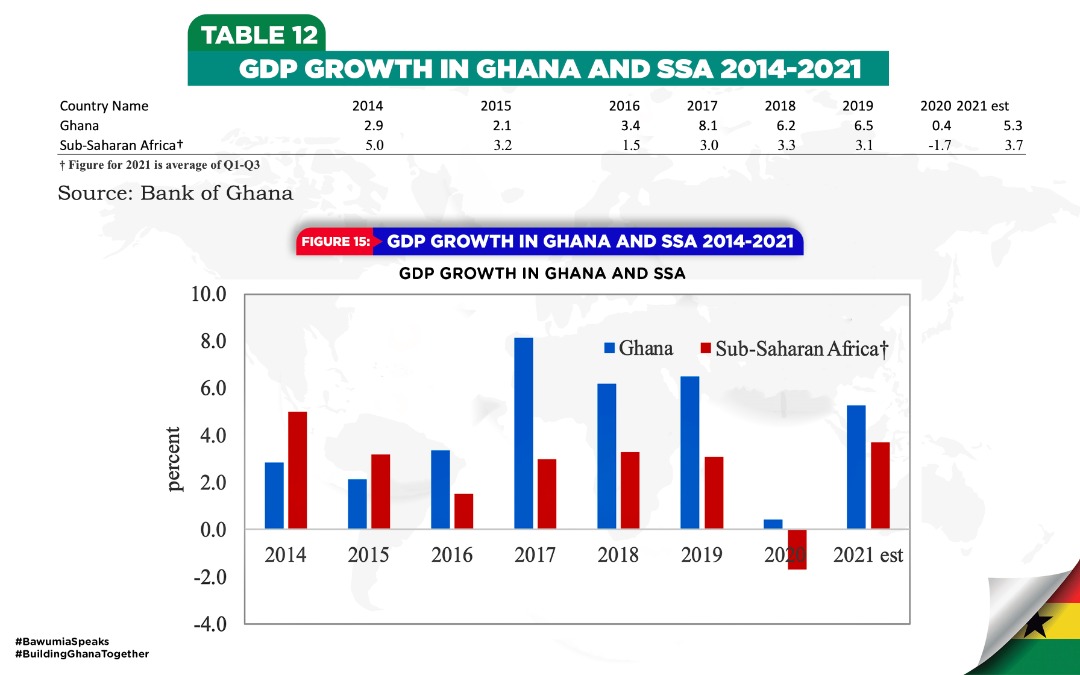

In the context of sub-Saharan Africa, GDP growth in Ghana has consistently outpaced average growth in sub-Saharan Africa since 2017. Even in 2020, when as a result of COVID 19, SSA recorded negative growth on average, Ghana was one of the few countries with positive growth. Between 2017 and 2021, growth in Ghana averaged 5.3% while that of SSA averaged 2.3% for the same period (Figure 15). GDP growth in Ghana was therefore more than double the SSA average for this period.

FIGURE 15: GDP GROWTH IN GHANA AND SSA 2014-2021

GDP Growth in Ghana and SSA

TABLE 12: GDP GROWTH IN GHANA AND SSA

2014-2021

Source: Bank of Ghana

The evidence and the data are therefore clear that we have made good progress in shifting from a focus on taxation to a focus on production.

UNEMPLOYMENT

Ladies and Gentlemen, the holistic approach to national development adopted by our government, anchored on shared economic growth bolstered by light manufacturing, industry, and investments in human capital, has invariably created opportunities and pathways for upliftment of the citizens through employment.

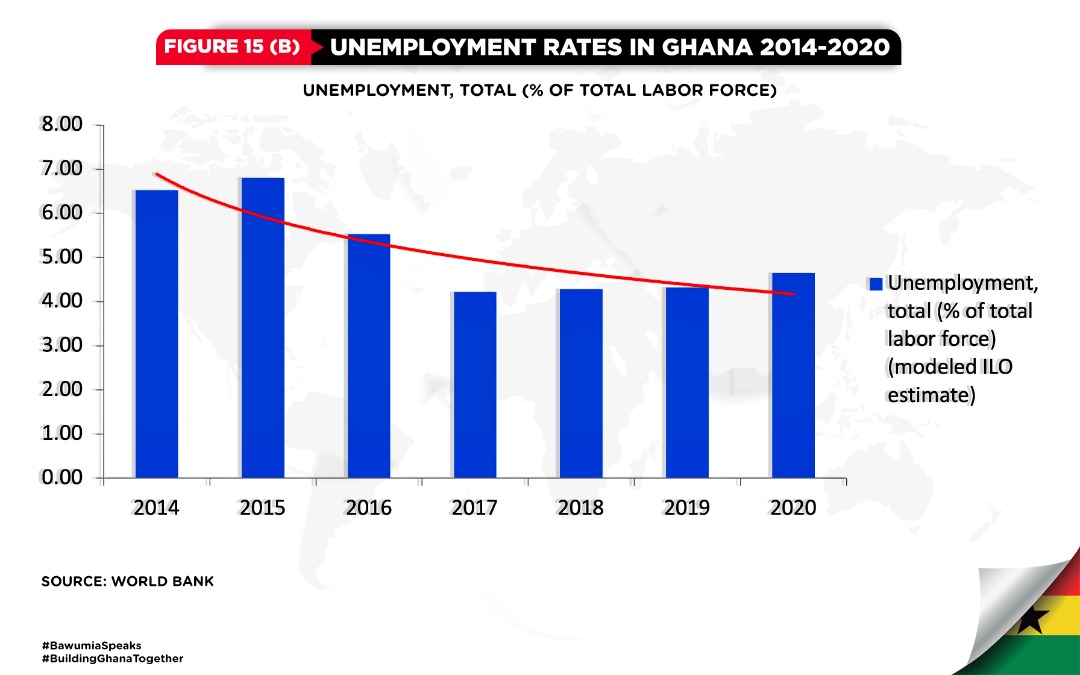

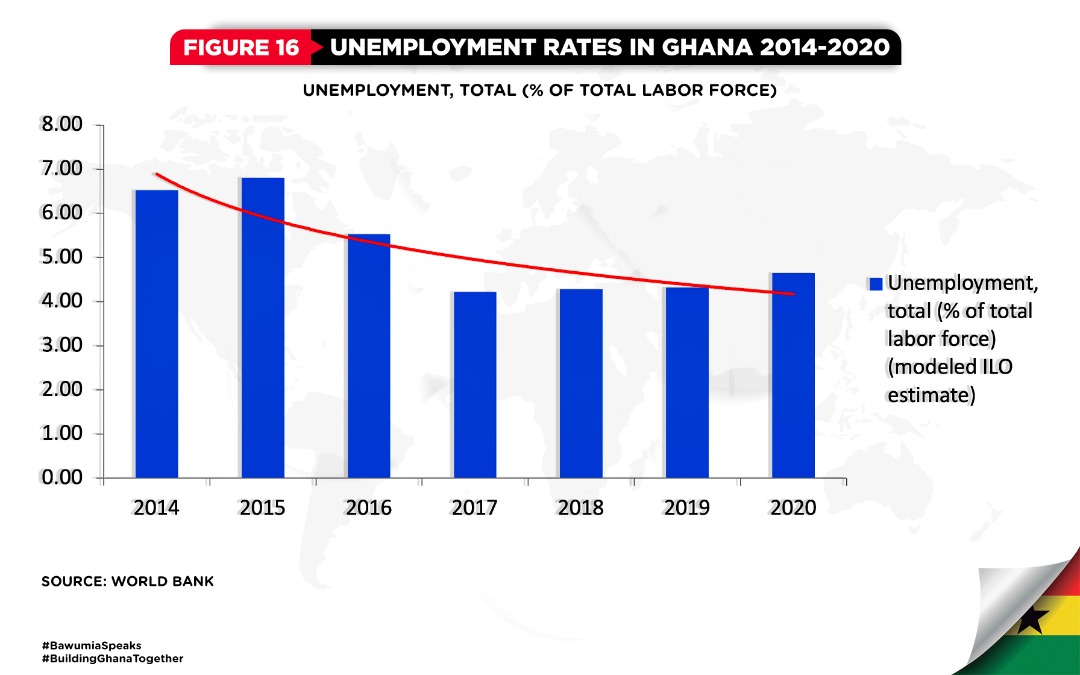

As shown in Figure 16, the robust growth in GDP has led to a decline in total unemployment. Based on World Bank data, the average unemployment rate in Ghana between 2014 to 2016 which stood at 6.29% declined to an average of 4.37% between 2017 to 2020.

FIGURE 16 UNEMPLOYMENT RATES IN GHANA 2014-2020

Unemployment, Total (% of total labor force)

8.00

7.00

6.00

5.00

Unemployment,

4.00

total (% of total labor force)

3.00

(Modeled ILO 2.00 estimate)

1.00

0.00

2014 2015 2016 2017 2018 2019 2020

Source: World Bank

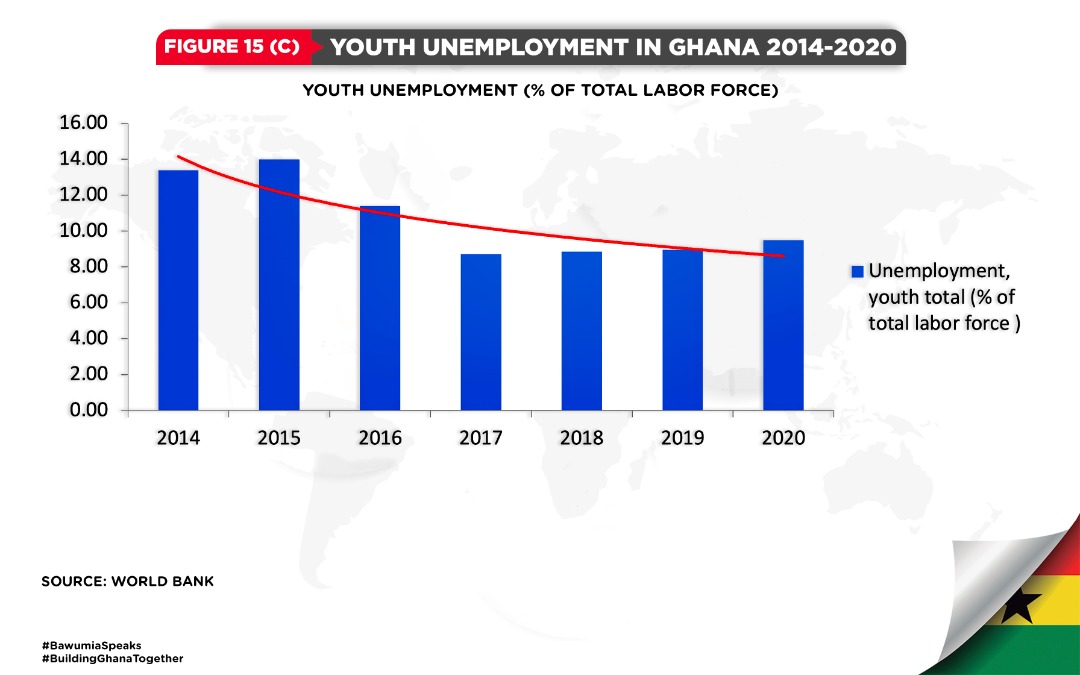

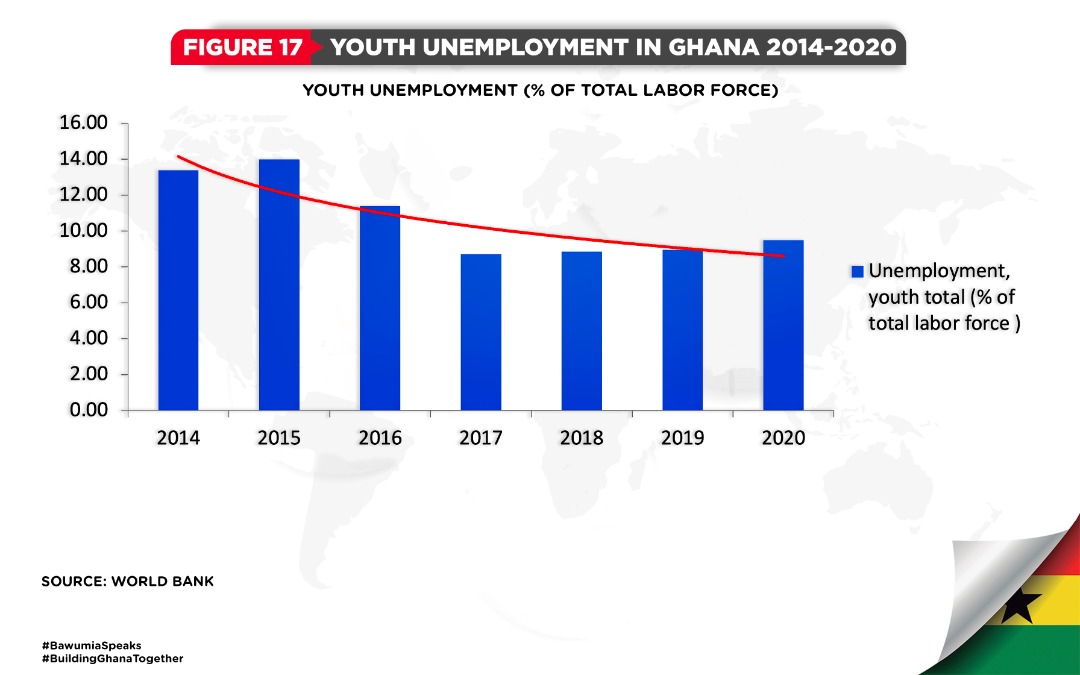

Youth unemployment has also registered a decline from an average of 12.92%, between 2014 to 2016 to an average of 9.00% between 2017 to 2020 (Figure 17).

FIGURE 17: YOUTH UNEMPLOYMENT IN GHANA 2014-2020

Youth Unemployment (% of Total Labor Force)

Unemployment,

youth total (% of total labor force)

2014 2015 2016 2017 2018 2019 2020

Source: World Bank

Government is also rolling out the YouStart initiative for the youth. It is a major initiative which will provide youth entrepreneurs with training, advisory services, and funding to enable them scale and grow their businesses.

EXCHANGE RATE DEVELOPMENTS

So how has the cedi performed under the leadership of Nana Addo Dankwa Akufo-Addo in the last five years and what is the cause of the recent sharp depreciation of the exchange rate for the cedi.

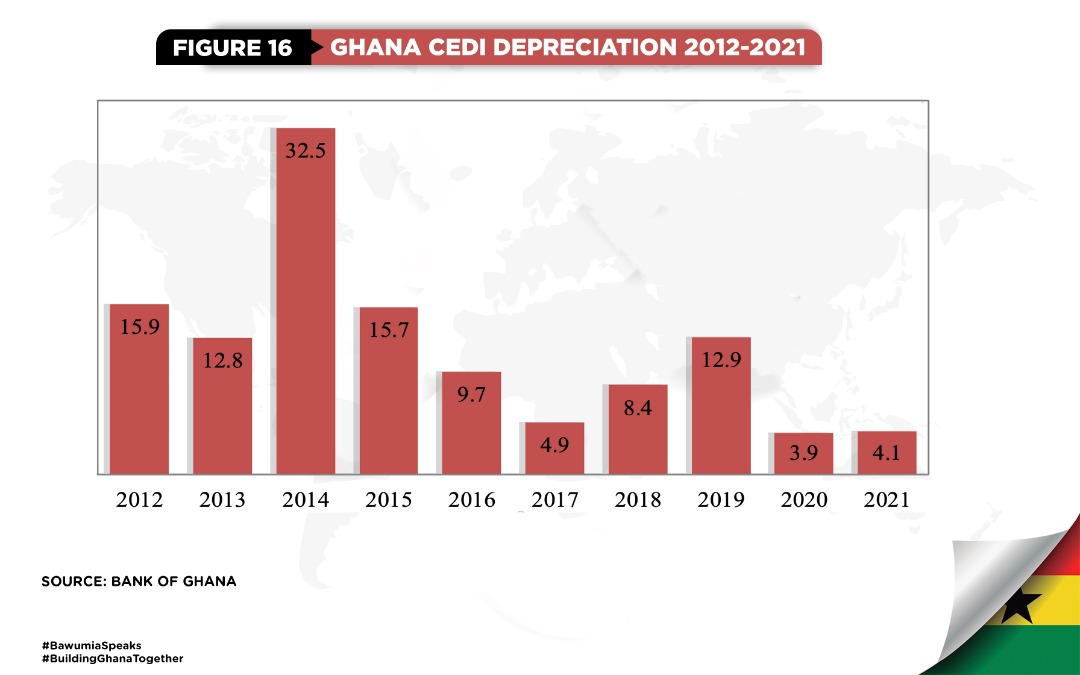

The data (Figure 18) shows a clear dichotomy for the depreciation of the cedi between 2013-2016 and 2017 – 2021. Cedi depreciation reached a high of 32.5% in 2014 and declined to 9.7% by 2016. The rate of depreciation further declined to 4.7% in 2017 before increasing to 12.9% in 2019 and declining again to 3.9% in 2020 and registering 4.1% in 2021.

FIGURE 18: GHANA CEDI DEPRECIATION 2012-2021

2012 2021

Source: Bank of Ghana

The data (Table 13) shows that average exchange rate depreciation during the 2017-2021, at 6.8% under our government, is more than twice as stable than during the 2013-2016 period where the average depreciation rate was 18%.

TABLE 13: AVERAGE ANNUAL RATE OF DEPRECIATION OF THE CEDI AGAINST THE US DOLLAR

| YEAR | AVERAGE ANNUAL RATE OF DEPRECIATION % |

| 1993-1996 | 27.95 |

| 1997-2000 | 25.19 |

| 2001-2004 | 11.04 |

| 2005-2008 | 6.77 |

| 2009-2012 | 10.09 |

| 2013-2016 | 18.0 |

| 2017-2021 | 6.8 |

Source: Bank of Ghana

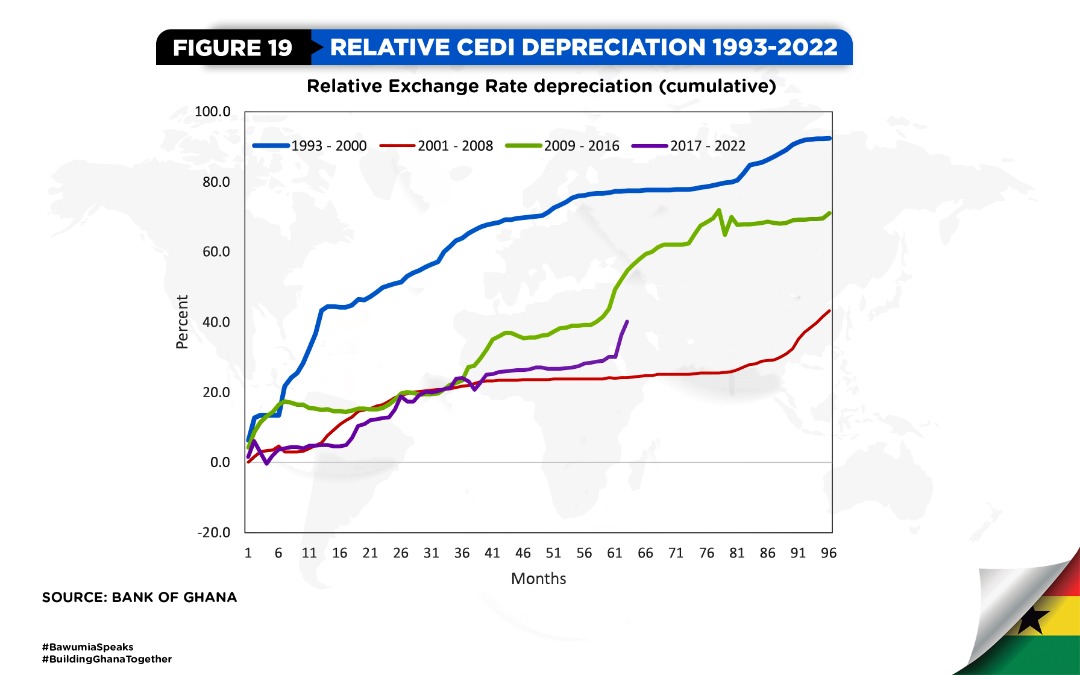

Figure 19 provides a graphical representation of the performance of the exchange rate of the years.

FIGURE 19: RELATIVE CEDI DEPRECIATION

1993-2022

Source: Bank of Ghana

In fact, in the history of the Fourth Republic, the worst performances for exchange rate depreciation happened during 1993-2000 and 2009-2016.

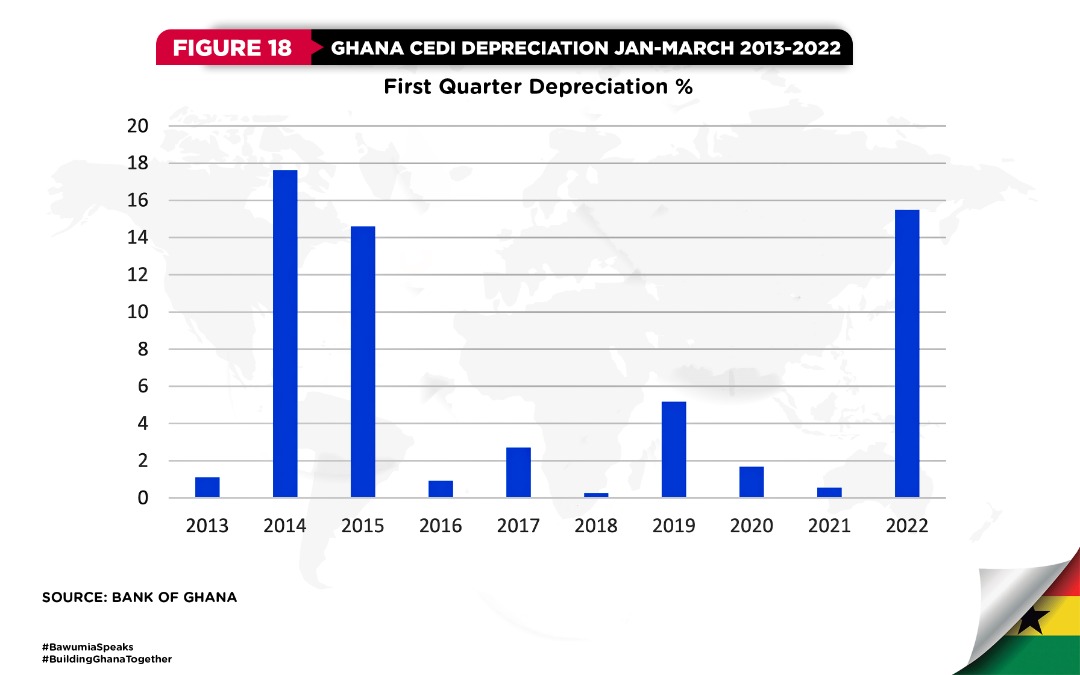

Depreciation of the Cedi in the First Quarter of 2022

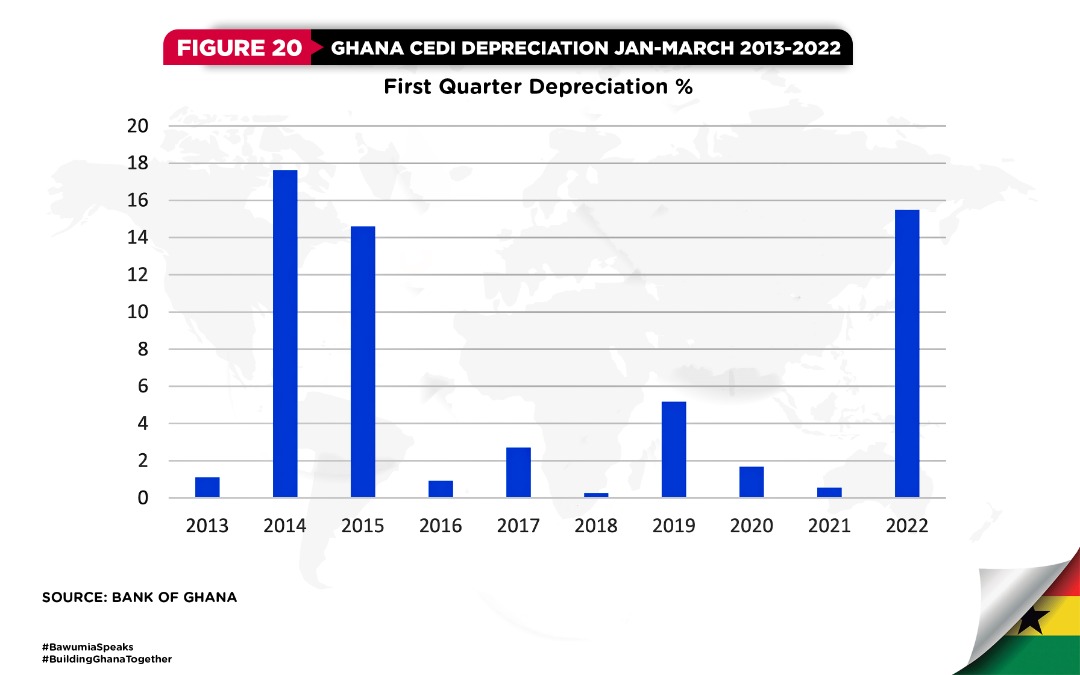

The first quarter of 2022 has however seen the sharpest first quarter depreciation of the cedi since 2015. Data from the Bank of Ghana shows that at the end of March the cedi had depreciated by 15.5% (Figure 20). So, what explains this?

FIGURE 20: GHANACEDI DEPRECIATION JAN-MARCH 2013-2022

First Quarter Depreciation %

Source: Bank of Ghana

Why did we see such a major depreciation of the exchange rate in the first quarter? A number of factors can be adduced:

– The financial markets assessment of the 2022 Budget generally concluded that the projected 40% increase in revenue underpinning the budget would likely not materialize and therefore the deficit will be higher than projected.

– The chaotic battle in parliament over the budget created uncertainty and signaled to the markets that the government may not be able to get most of its programs passed in a tightly balanced parliament. This further reinforced the lack of confidence investors in the budget.

– Furthermore, delays in implementing major tax reforms such as the benchmark policy reversal, tax exemptions bill, common platform for property tax, and the review of fees and charges appeared to support the assessment of the market that the government will have difficulty in getting its programs through parliament.

– To add to this negative market sentiment, there was a sovereign credit ratings downgrade by Fitch and Moodys as a result of concerns about fiscal and debt sustainability. This resulted in an unwillingness of foreign investors to rollover holdings of domestic debt. They demanded foreign exchange to repatriate their investments.

– The lack of access to the sovereign bond market by emerging markets and Ghana’s announcement that it would not issue a sovereign bond in 2022 worried investors about the adequacy of Ghana’s foreign exchange reserves going forward. They therefore wanted to get a hold of foreign exchange now and this led to an increase in the demand for US dollars on the market.

– The increases in interest rates by central banks in the US and other advanced economies also made cedi assets less attractive and led to a move out of cedi holdings.

– The conflict between Russia and Ukraine which started in February (at the same time as the significant depreciation of the cedi started) and the associated increase in crude oil prices and overall cost of living globally resulted in higher demand for US dollars by foreign investors, oil importers (BDCs) as well as other importers on the local foreign exchange market.

– There was also speculative demand for the US dollars as panic set in.

The combination of these factors resulted in a sharp depreciation of the cedi exchange rate in the first quarter. The depreciation of the cedi was fundamentally about the market’s assessment of the fiscal stance of government and its implications for fiscal and debt sustainability. This was the primary factor in the ratings downgrade.

ADDRESSING THE DEPRECIATION OF THE CURRENCY

It therefore called for the appropriate fiscal adjustment to address the structural rigidities and ensure that the fiscal targets for 2022 and beyond are met. Basically, we needed to cut expenditure and increase revenues of the magnitudes that would allow us to be on the path of fiscal and debt sustainability.

Our assessment is that it is not a financing problem. So more borrowing will not solve the problem unless it provides fiscal space to undertake critical reforms on the expenditure and revenue sides of the budget as well as increasing economic growth.

Government has taken the decision and announced some revenue and expenditure measures in this regard. These include:

Expenditure Measures

• Discretionary spending is to be further cut by an additional 10%.

• on-going measures to eliminate “ghost” workers from the Government payroll by end December 2022,

• renegotiation of the Energy Sector IPPs capacity charges,

• prioritization of ongoing public projects over new projects,

• pursue re-profiling strategies to reduce the interest expense burden on the fiscal; and

• 50% cut in fuel coupon allocations for all political appointees and Heads of government institutions, including SOEs,

• moratorium on the purchase of imported vehicles for the rest of the year,

Revenue Measures

• implementation and collection of the revised Property Rate,

• implemention of the E-VAT/E-Commerce/E-Gaming initiatives,

• roll out the simplified tax filing mobile application for all eligible taxpayers,

• prioritize the Revenue Assurance, Compliance, and Enforcement (RACE) Programme to plug revenue leakages.

• No duty no exit from the MPS terminal at the Tema port.

These are all steps in the right direction.

In response to increasing inflation and exchange rate depreciation, the Bank of Ghana has tightened monetary policy by increasing its policy rate by 2.5% from 14.5% to 17% and increased reserve requirements for the banks from 10% to 12%. The capital adequacy ratio has also been increased from 10% to 13%. A new foreign exchange auction for oil importers (BDCs) has also been implemented by the Bank of Ghana and this would help reduce volatility on the foreign exchange market.

The announcement of these fiscal and monetary policy measures along with the passage of the revenue measures in the budget by parliament has increased the confidence of investors about Ghana’s fiscal outlook and appears to have restored some calm to the foreign exchange market.

Given the uncertainty surrounding geo-political developments and their impact on the economy, we will continue to monitor the data and are ready to take further measures as may be required to meet our budget targets.

The relaxation of the COVID-19 restrictions and the opening of the land borders is expected to result in increased economic activity and economic growth.

In summary, the data clearly shows that overall, notwithstanding the impact of COVID-19, the economic fundamentals of inflation, interest rates, exchange rates, GDP Growth, trade balance, current account balance, gross international reserves during the 2017-2021 period are largely much stronger than they were in the 2013-2016 period. The fiscal deficit/GDP as well as debt/GDP variables are weaker given the COVID related expenditures, banking sectors clean-up costs and excess capacity payments to IPPs.

We should note that no government in the history of Ghana has had to deal with a global pandemic which resulted in the worst global depression since the 1930s, and a War between Russia and Ukraine and its implications, and financial sector crisis pretty much in succession. Under these circumstances, our management of the fundamentals has been rather remarkable.

TRANSFORMING THE ECONOMY- THE NEW ECONOMY

The government of Nana Akufo Addo set out to build a modern prosperous economy. There are several elements of this economic transformation:

Industrialization

– IDIF

– Automotive Industry

– Bauxite and Aluminium Integrated Industry

Agriculture

• Planting for Food and Jobs

• Rearing for food and Jobs

• Tree Crop Development Authority

Infrastructure

– Roads

– Railways

– Dams

– Warehouses

– Schools

– Hospitals

– Airports

– Water

EDUCATION AND SKILLS

– Free SHS

– Free TVET

– Investment in TVET institutions

ECONOMIC TRANSFORMATION THROUGH DIGITALIZATION

We can only build a vibrant modern nation if we have strong systems and institutions that work. Otherwise, we will be stuck in a vicious cycle of rhetoric and underdevelopment.

The focus of economic management by successive governments since independence in Ghana has been on crisis management as a result of factors such as collapse in commodity prices, increase in oil prices, debt unsustainability, political instability, macroeconomic instability, etc. Governments, have by and large, not focused on the underlying system that underpins economic activities.

The goal upon assumption of office was to quickly transform our economy by leveraging on technological innovations as a means to leapfrog the development process, overcome legacy problems, and improve both economic and public sector governance. This is why digitalization has been a major area of focus for our government.

Our strategy since 2017, has been to build a new “system” through digital transformation.

I will now come to how we are using digitalization to transform the economy.

ADDRESSING THE ISSUE OF UNIQUE IDENTITY

1. On coming into office, we moved quickly with the issuance of biometric national ID cards (The Ghanacard) to the population. The Ghanacard project was initiated by President Kufuor but was practically abandoned for 8 years.

2. So far, 15.9 million people have been enrolled on the Ghanacard by the NIA. With the Ghanacard the identity of people (even dead people) can be established using their fingerprints. This is one of the most transformational projects implemented by any government since independence.

A PROPERTY ADDRESS SYSTEM FOR GHANA

3. To solve the problem of a lack of a working address system in Ghana, we have leveraged on GPS technology to implement a digital address system for Ghana capturing every square inch of land. In the process, The Land Use and Spatial Planning Authority (LUSPA) has identified and provided unique addresses for 7.5 million properties in Ghana along with street names and house numbers. The process of affixing address plates to properties are ongoing.

PROMOTING FINANCIAL INCLUSION

4. Mobile money interoperability has made it possible to transfer money seamlessly across different mobile money providers and between bank accounts and mobile wallets. Today, because of mobile money interoperability (MMI), you can transfer money from a customer of one mobile money service provider to a customer of a different mobile money service provider and also make payments from your mobile money account into any bank account and you can receive payments from any bank account into your mobile money account. You can also receive remittances from abroad directly onto your mobile phone without the need to go to a bank or Western Union Money Transfer.

Because the mobile money account performs just like a bank account, as a result of MMI, over 90% of Ghanaians have bank accounts or mobile money accounts that function like bank accounts. We have practically solved the problem of financial exclusion in Ghana.

5. I should note that Ghana is the first country in Africa and one of the few in the world to achieve this type of interoperability between bank accounts and mobile wallets. Even in the USA, the Federal Reserve Bank does not have interoperability in its Real Time Payments Network. On March 15 this year Rwanda attained mobile money interoperability between Telcos which allows clients of one telco to send money to customers of another network. They have not yet been able to achieve interoperability between mobile wallets and bank accounts as in Ghana. In this area, we are way ahead of most countries in the world.

6. Achieving mobile money interoperability (MMI) in Ghana is therefore no small feat, especially at the cost ($4.5 million) we did it. The data shows that because of MMI, Ghana is the fastest growing mobile money market in Africa.

7. At the end of 2016, total cumulative value of mobile money transactions were GHC 78.5 billion. Following MMI, the total cumulative value of mobile money transactions have increased to GHC 978.3 billion in 2021 (a twelve-fold increase!).

8. Today, the payment system reforms we have put in place has made it easy to open a traditional bank account. For many banks, anyone can open a bank account remotely through their mobile phones without visiting a branch or filling out forms. Clients need only a valid national ID card and no additional documentation to open an instant account.

9. The digital payments infrastructure is boosting e- commerce in Ghana. Businesses are booming over Instagram, Facebook, Twitter, etc. Many people who cannot afford to rent or build shops are able to do business on the internet at little cost with deliveries helped by digital address and payments using mobile money interoperability.

ADDRESSING EFFICIENT DELIVERY AND CORRUPTION IN THE PUBLIC SERVICE

10. Our approach to improving the delivery of public services is to minimize human contact as much as possible. Therefore, we embarked on an aggressive digitalization of the processes of service delivery across many public institutions with coordination from my office:

11. Digitalization of the passport office: With digitization the average turnaround time for the acquisition of passports has been significantly reduced and today you can apply for your passport from home, and it can also be delivered for you by courier at home using your digital address. The digitization of the passport application process has resulted in a major increase in the number of passports processed annually as well as the revenue yield to the passport office.

12. In 2017 the passport office processed a total of 16,232 applications with revenue of GHC1.1m, In 2021, the passport office received and processed 498,963 online passport applications with a total revenue of GHC56.7m. Digitization has dealt a severe blow to corruption at the Passport Office.

13. Digitalization of the ports- Paperless Ports: Previously, the bureaucracy in the clearing of goods at Ghana’s ports involved a lot of paperwork and used to be largely manual. This caused delays, corruption, inefficiencies, frustration and loss of revenue to government. Many citizens who had cleared goods at the country’s ports had horror stories about them experiences at the ports. The introduction of a paperless port system has reduced the layers and simplified the process, reduced the time needed to clear goods and the avenues for corruption and increased efficiencies and revenue mobilization at the ports.

Customs revenue has increased from GHC 10.3 billion in 2016 to GHC16.1 billion in 2021. Digitization has clearly reduced corruption at the ports.

14. Digitalization of the DVLA: The DVLA offers two traditional services: Driver Licensing and Vehicle Registration related services. These services have been fully digitized. With the digitalization of the drivers licenses in 2019, the DVLA experienced an increase in service by 109% in 2020.

The average cost at the DVLA is GHc 500.00 and GHc 550.00 for vehicle and driver licensing services respectively compared to the cost of between GHc 2000 and GHc 3000.00 respectively under the ‘goro’ market. Thus, the digitization has saved the DVLA customer the cost of vehicle services by 200% and driver licenses service by 264%, at the minimum.

The DVLA generated an average revenue of GHc 71.5 million in the four years (2013-2016) prior to digitisation as compared to the average revenue of GHc 168.4 in the four years (2017-2020) with digitisation.

15. Motor Insurance Database: The National Insurance Commission has also implemented the Motor Insurance Database. The objective of the introduction of the Motor Insurance Database is to curb the menace of vehicles with fake motor insurance stickers plying our roads, thus, endangering lives and property.

16. With the digitalization of motor insurance in Ghana, all insurance policies, which now have key security features, have been synchronized to a national database, which can be accessed simply with any mobile phone by the insured, the Police, and the general public.

17. Members of the public can also self-check the authenticity of their insurance policy by dialing a USSD code *920*57# and follow the instructions thereafter to know the insurance status of the vehicle. Therefore, us Police and general public can easily check from them phones and devices on the road which vehicles have insurance or not.

18. Following the implementation of the motor insurance database, the the growth of the motor insurance industry increased from 19% in 2019 to 37% in 2020 and 26% in 2021. The value of the business undertaken increased from GHC 566 million in 2017 to GHC2.3 billion in 2021. Digitization has dealt a severe blow to corruption in the insurance industry with no room for fake insurance certificates.

Births and Deaths Digitalization:

19. The process of digitalization of the records is almost complete and the three databases have been cleaned up and integrated. Furthermore, we are integrating the births and deaths register with the databases of Ghana Health Service, National Identification Authority, Ghana Statistical Service, Immigration and the Police so that the record of births and deaths should be consistent across all these databases. This is expected to start later this year.

20. Starting later this year, it is envisaged that every new born child will within a few months get a Ghanacard number but the actual card will be issued when the child is grown and the biometrics are fully formed (after age 6). Digitization and the integration of the databases will deal a severe blow to corruption at the Births and deaths registry.

21. Scholarship Secretariat Applications:

In the past, candidates applying for scholarship usually had to travel from all parts of Ghana to Accra to take part in the application process. This caused a great deal of inconvenience for applicants seeking government sponsorships. The manual processes of the Scholarship Secretariat resulted in an inefficient administration of scholarships in the country.

22. With the digitalization of the scholarship secretariat, candidates can now apply for scholarship from the comfort of their homes, take an aptitude test and be interviewed in their own districts.

23. Ghana.Gov Platform:

To make it easy to access government services, Government has launched the Ghana.gov portal, a one- stop shop for accessing government services. This means that you should be able to apply for and obtain any government service online through the Ghana.Gov platform. All payments go directly into the government account. The Ghana.Gov platform has so far received a total GHC55.7 billion of payments to government since its inception. It is quite likely that if these payments were made through cash, quite a bit would have ended up in private pockets. Digitization has therefore dealt a severe blow to corruption involved in the collection of payments by different institutions for government.

24. Buying Electricity credit on your mobile phone through the Mobile ECG App has provided relief to customers who no longer have to queue for long hours to buy electricity units. Also, for people whose credit runs out odd hours they can purchase electricity credit on their mobile phones.

DIGITIZATION OF FOOTBALL TICKETING

To address the inefficiency and corruption within the ticketing regime for football, the Ministry for Youth and Sports, in collaboration with the National Sports Authority and the GFA piloted an e-ticketing system for the recent World Cup qualifying match between Ghana and Nigeria at the Kumasi sports stadium. People who wanted to buy tickets could do so on the mobile phone. No need to waste time queuing for tickets or buying them from the black market. It was a successful pilot and yielded the highest ever revenue (GHC 1,423,400) for a football match in the history of Ghana.

INSERT GRAPHIC ON E-TICKET

This system is now going to be rolled out to all major stadia in Ghana. Digitization is going to deal a severe blow to corruption in the ticketing for football games and result in higher revenues for our football clubs.

DIGITIZATION OF PRE-MIX FUEL DISTRIBUTION

The issue of pre-mix distribution is one that has been problematic for fishermen in Ghana. The complaints never seem to go away because of the role of middlemen. Many fishermen do not get the subsidized supplies and have to buy on the black market. In response to this, the Ministry of Fisheries and Aquaculture has begun the process of digitization of pre-mix distribution. When completed, registered fisher folk should be able to directly obtain them pre-mix fuel without the intervention of third parties.

A similar exercise is ongoing by the Ministry of Food and Agriculture to digitize fertilizer distribution in Ghana.

The process is near completion and should be rolled out later this year.

DOMESTIC REVENUE MOBILIZATION

25. Ghana has a major challenge in the area of domestic revenue mobilization. The tax/GDP ratio is about 14.0% compared to 27% for South Africa and 34% for the advanced (OECD) countries. Most adults are outside the tax net and compliance are very low. At the beginning of 2017, only 4% of the adult population of Ghana had Tax Identification Numbers (TIN).

26. Broadening the tax net is therefore imperative. In this regard, a number of digital initiatives have been implemented to broaden the tax base and create a vehicle for enhanced domestic revenue mobilization.

To increase the number of people with TIN numbers, we took the decision to designate the Ghanacard number as the TIN number. In doing this we increased the percentage of adults with TIN numbers from 4% to 85%!

27. The SSNIT, NHIS, TIN, Passport, CAGD payroll, DVLA etc. have been linked or are being linked to the NIA database. Today your SSNIT number is your Ghanacard number, your NHIS number is your Ghanacard number, your TIN number is your Ghanacard number etc. The integration of the databases is allowing us to successfully weed out ghost workers on payroll. A biometric audit of the National Service Scheme payroll alone found 14,027 ghost workers and saved Ghana GHC 112 million. A wider audit is taking place for the CAGD payroll.

28. Digitalization of the tax filing process: Many people, including highly educated people, find the process of filing taxes complex. To make it easier and less cumbersome to file taxes, I challenged the GRA to come up with a simple to use mobile App to enable ordinary people file and pay taxes using their mobile phones. I am happy to announce that the GRA will roll this new Mobile App out in the next couple of months.

29. The tax filing Mobile App has been designed specifically, to make the filing of taxes very simple. Once you sign on, you will be asked to answer a number of simple questions. Once completed, you can hit the send button and your tax liability or refund will be calculated. You can then proceed to pay using mobile money, or any other channel. You will receive an electronic receipt of your tax payment. You will also automatically receive an electronic tax clearance certificate. So, you no longer need to apply separately for a tax clearance certificate. You will get one automatically once you have successfully filed your taxes. The era of fake tax clearance certificates would soon be over.

IMPROVING THE EFFICIENCY OF HEALTHCARE DELIVERY

30. Digitalization of Hospitals and Medical Records:

31. We have embarked on the connection of health facilities under the Ghana Health Service (GHS) on to one digital platform. So far, all teaching hospitals and all regional hospitals have been connected and can talk to each other. Thirty-six health facilities in the Central region have also been connected to the digital platform in a pilot scheme. The process for other hospitals is ongoing and we expect that it will be completed next year.

32. The Minister for health has informed us that if you are referred from a hospital like Tamale Teaching Hospital to Korle-bu Teaching Hospital in Accra, you do not need to carry a folder. All your records will be seen and monitored by the doctor in Korle Bu when you arrive. Patients will have only one digital folder wherever they go.

33. National Health Insurance Authority (NHIA):

Digitizing the operations of the NHIA has helped reduce fraudulent claims. The renewal of all national health insurance registrations used to take place at the various NHIA district offices. This led to backlogs and long queues. In some instances, people slept for days at some district offices. These delays hampered the operations and limited the revenue streams of the NHIA.

34. Following digitalization, renewal of health insurance registration via mobile phone (*929#) has eliminated these bottlenecks and also increased access to health care by those who need the services most. This has led to an increase in renewals by 70% while new registrations have increased by 41.4% per annum.

Digitization is dealing a severe blow to corruption in the health service.

Medical Drones

35. Ladies and Gentlemen, hospitals and clinics in remote and largely rural communities like Nyangbo Sroe in Afajato South, Afram Plains or Yunyoo have difficulty getting medical supplies especially in times of emergencies involving, for example snake bites, child- birth, blood supplies, floods, etc. Many lives are needlessly lost because the hospitals are unable to access critically needed supplies on time. To address this problem, Ghana opted to partner Zipline, the world’s largest automated on-demand delivery service for medical supplies.

36. Ghana was the second country in Africa (after Rwanda) to implement the delivery of medical supplies to remote areas through drones.

37. There are six Zipline Distribution Centres (DC) in Omenako, Mpanya, Vobsi, Sefwi Wiawso, Kete Krachi and Anum. The next two distribution centers will be located in Funsi (Upper West) and Kintampo (Bono) in 2022. This will bring Zipline coverage to the whole of Ghana. Zipline has made millions of deliveries of medicines, blood and vaccines to very remote parts of Ghana and has saved many lives.

38. I should add that Ghana currently has the largest medical drone delivery service in the world! What is even more impressive is that the drone centers are 100% manned by young talented Ghanaians.

39. National Electronic Pharmacy Platform:

The Pharmacy Council in collaboration with the private sector has completed work on a digital platform for all pharmacies in Ghana and a pilot of 45 pharmacies is has been completed.

40. Basically, the National Electronic Pharmacy Platform will offer the opportunity to everyone through a mobile phone to upload your prescriptions and find out which pharmacies near you have the medicines. Secondly you can compare the prices for the same drug offered by different prices so that you can buy from the lowest priced pharmacies. 41. You will also be able to order the drug and pay for it on the phone through mobile money or other channels.

The medicines are then delivered to the customers at home through a courier service.

42. The National Electronic Pharmacy Platform will be formally launched in the next few weeks. This will make Ghana one of only a few countries in the world with a national scale E-pharmacy.

DIGITIZING THE EDUCATION SECTOR

43. To make sure our education sector is not left out of the digital revolution, we are providing free Wifi to us senior high schools (710), 46 Colleges of Education, 260 district education offices, and 13 public universities. A lot of progress has been made in this direction.

44. We have started the distribution of laptops to teachers.

45. Next step is to provide tablets with pre-loaded textbooks and learning materials to senior high school students.

Ladies and Gentlemen, with industrialization, agriculture, skills education and digitalization, our government is tackling some key challenges this country has faced since independence.

That notwithstanding, we have acknowledged the reality of the hardships and suffering people face in their everyday lives. In opposition we promised to alleviate the suffering of Ghanaians. So, what have we done to mitigate the suffering?

ALLEVIATING THE SUFFERING OF GHANAIANS

Ladies and Gentlemen, the record shows that the NPP government under the leadership of Nana Akufo Addo is a government that is predisposed and committed to reducing the suffering of Ghanaians. Over the last five years we have implemented measures to alleviate or mitigate the suffering of Ghanaians over the last five years:

1. We have paid the bills of some $1 billion annually in excess capacity charges) to keep the lights on and “dumsor” away.

2. Reduced electricity tariffs cumulatively by 10.9% compared to a cumulative increase of 264% under the previous government.

3. Provided free water for households for a year during COVID.

4. Provided free electricity for lifeline users and a 50% reduction for other users for a year. The electricity tariffs over the last five years have seen the lowest increase for any five-year period over last thirty years!

5. We Doubled the Capitation Grant (From GH¢4.5 to GH¢10) for basic schools

6. Created jobs and stopped the freeze on recruitment in the public sector. Hundreds of thousands of people have been recruited.

7. Unlike the private sector which laid off thousands of workers and reduced salaries., there were no layoffs of public sector workers during COVID. Additional 58,000 nurses recruited on a permanent basis.

8. Increased the share of the DACF to persons with disabilities by 50%.

9. Exempted Kayayei from market tolls.

10. expanded the LEAP by 150,000 beneficiaries.

11. Expanded School Feeding from 1.6 million children to 2.1 million children, and also increased the amount spent on each child by 25 percent.

12. Restored Teacher Training Allowances.

13. Restored Nursing Training Allowances.

14. Established the Nation Builders Corps (NABCO) of 100,000 graduates to build the job skills of us graduates to be absorbed into the workforce.

These are programs we have continued with notwithstanding the current challenges which has resulted in sometimes delays in payments.

15. Abolished the three months’ pay policy for teachers who were paid for only 3 months after working for 2-3 years.

16. Absorbing the cost of BECE and WASSCE exam registrations.

17. Subsidized fertilizer for farmers.

18. Abolished or reduced at least 21 taxes including excise duty on petroleum, VAT on financial services, real estate, domestic airline tickets, etc.

19. Reduced corruption associated with obtaining public services by digitization of service delivery

20. Provided GHC600 millions of COVID funds for small businesses.

21. made it easier for the renewal of NHIS membership through mobile phones.

22. made it easier to clear goods from the port through the paperless process.

23. Spent GHC25 billion to save the deposits of 4.6 million people and prevent a collapse of the banking system. Thousands of business enterprises would have collapsed otherwise with attendant job losses.

24. We have implemented free TVET.